High Probability ETF Trading Report – Pullbacks in the Energy Patch: OIH, DIG, IYE

High probability ETF traders looking for tomorrow’s potential pullbacks might want to turn their attentions back to the energy patch – where sellers continue to push ETFs lower and deeper toward oversold territory.

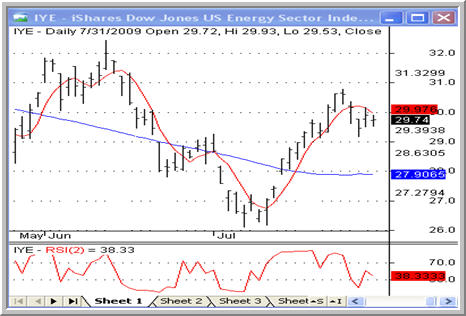

None of the three ETFs in today’s report have slipped into oversold territory just yet. Intraday on Friday, all three have 2-period RSIs in the 30s. This means that the ETFs are dominated by sellers, but those sellers have not yet taken these funds down into the “sweet spot” of truly oversold territory.

Oil Service HOLDRS ETF

(

OIH |

Quote |

Chart |

News |

PowerRating)

Want to learn how to trade ETFs like OIH, DIG and IYE? Join Larry Connors for a free introduction to his special 2 1/2 Day High Probability ETF Trading Seminar coming in August. The presentation is free and will help introduce traders to the world of high probability ETF Trading. Click here to save your spot today!

When it comes to high probability ETF trading strategies, we prefer to look for opportunities among country ETFs and equity index ETFs. This is because our research indicates that these kinds of ETFs do a superior and more reliable job of oscillating back and forth between overbought and oversold conditions.

ProShares Ultra Oil & Gas ETF

(

DIG |

Quote |

Chart |

News |

PowerRating)

Sector ETFs – like OIH, DIG and IYE – are next in line followed by commodity ETFs.

What is interesting about the ETFs in today’s column is that they straddle the line between sector and commodity ETFs. While all three are based on equities rather than the actual commodity (crude oil, in this case), those equities are based on commodities.

iShares Dow Jones U.S. Energy Sector Index ETF

(

IYE |

Quote |

Chart |

News |

PowerRating)

What does this mean? In part, it means that these ETFs may be more likely to trend compared to country and equity index ETFs. One strategy for dealing with these ETFs is to ensure that they are extremely oversold (or overbought if looking to sell short) before taking a position in them. This will help make sure that the market for the ETF is already overstretched to the downside, making a snapback rebound all the more likely.

Larry Connors will be conducting a 2 1/2 day High Probability ETF Trading Seminar beginning August 14. If you’d like to attend a free online presentation explaining the concepts of High Probability ETF Trading and introducing the 2 1/2 day Seminar coming in early August, please call 1-888-484-8220 ext. 1 or click here to register today.

David Penn is Editor in Chief at TradingMarkets.com.

Want updates on our latest articles? Have something to say to David Penn or

the staff at TradingMarkets? Follow David on Twitter at @Penn_TM and TradingMarkets at @Trading_Markets. You can also join the

discussion on Facebook by logging onto our fanpage

.