TradingMarkets Turnaround Tuesday

With the market closing lower for five out of the last six sessions, will Turnaround Tuesday live up to its name?

For traders who focus on buying low and selling high, there are two types of turnarounds in the market that those looking to buy stocks cheap and sell them dear should keep in mind.

The first type of turnaround occurs in oversold markets, when stocks that have been in good shape, moving higher with higher highs and higher lows, run into temporary selling pressure and begin to move lower. Here, the turnaround comes as these stocks become increasingly oversold, eventually reaching the point at which buyers cannot resist the low prices any longer and begin to buy, often aggressively.

The second type of turnaround–and the kind of turnaround that is the focus of the stocks in today’s report–occurs when stocks that have been battered and beaten down, trading below the 200-day moving average, begin to attract enough buyers to cause the stocks prices to begin rising. The turnaround with these stocks comes as those stocks rallying off the lows become too overbought, encouraging traders to take profits and eventually sending those stocks back down to the depths from when they came.

So, for the pullback/bounce trader, the true swing trader in our opinion, there are two different turnarounds that can make money when trading stocks: strong stocks moving higher after being dramatically oversold, and weak stocks moving lower after being dramatically overbought.

Looking again to the latter case of overbought stocks, how can we tell if a stock is truly overbought? One of the best resources for short term stock traders is the classic technical indicator, the Relative Strength Index. However, we have found that at least two modifications should be made to the traditional RSI in order to maximize its effectiveness for traders in the short term.

The first modification is to change the period length from the standard 14-periods to only 2-periods. The value of this modification should be apparent. For the short term stock trader, it is the most recent price action that is most important. In this, the additional 12 periods of the traditional RSI only add noise to the signals from the indicator that matter most in the short term. A 2-period RSI makes sure that the short term trader is only focused on short term information.

The second modification was to raise the bar for what qualified as overbought and oversold. The traditional RSI considers a stock overbought when its RSI reaches 70, and oversold when its RSI reaches 30. This, in our view, is much too generous and, again, does not focus on what is most important for short term traders.

For us, a market is overbought when its RSI climbs above 90 and oversold when its RSI moves below 10. We like to highlight special instances of truly overbought and oversold markets when the RSI values rally above 98 and fall below 2, respectively.

Click here to read our research into trading stocks using the 2-period RSI.

All the stocks in today’s report have 2-period RSI values of 95 or more, putting them in or near that category of “special instances” that we think short term traders should focus on when looking to bet against stocks. I have included the specific 2-period RSI values so that traders can see exactly how overbought these stocks are.

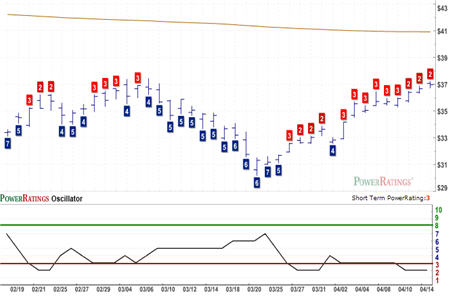

All four stocks also have Short Term PowerRatings of 2 or 3, marking them as stocks that are likely to underperform the average stock over the next 5 to 8 days.

Anglogold Ashanti

(

AU |

Quote |

Chart |

News |

PowerRating). Short Term PowerRating 2. RSI(2): 98.57

Linn Energy

(

LINE |

Quote |

Chart |

News |

PowerRating). Short Term PowerRating 2. RSI(2): 96.07

Northeast Utilities

(

NU |

Quote |

Chart |

News |

PowerRating). Short Term PowerRating 3. RSI(2): 98.39

Unisource Energy

(

UNS |

Quote |

Chart |

News |

PowerRating). Short Term PowerRating 3. RSI(2): 99.89

Tired of losing money trading breakouts and breakdowns? Our special, Free Report, “5 Secrets to Short Term Stock Trading” will show you some of the key strategies and attitudes that traders throughout history have used to determine the right time to buy and the right time to sell. Click here to get your free copy of “5 Secrets to Short Term Stock Trading”–or call us today at 888-484-8220.

David Penn is Senior Editor at TradingMarkets.com.