Three for Thursday: PowerRatings Stocks Ready to Crack

This market is truly unreal. It just keeps powering higher despite questionable internals. Even negative news from retail giant Wal-Mart this morning failed to put much of a damper on the bulls all out party.

Indexes hit yearly highs yesterday as investors scampered to catch the bullish train before it was too late. Today, despite the negative news and surging U.S. dollar stocks are slightly higher to breakeven bellowing the exuberance. We now have experienced seven months of upward motion without a significant pullback. Obviously, this can not go on forever and it may be time to start looking for specific stocks ready to crack.

It’s difficult for most traders to locate overextended shares in these times of raging bull markets. We have developed an easy 3 step process to help you locate companies ready to pull back prior to them actually falling so that you can capture maximum short-term profits. This method has been tested extensively, across all market conditions and has proven itself time and time again.

The first and most critical step is to only look at stocks trading below their 200-day simple moving average. This assures that the stock isn’t in a long-term uptrend that may likely continue.

The second step is to drill deeper into the list locating stocks that have climbed 5 or more days in a row, experienced 5 plus consecutive higher highs, or are up 10% or more. Yes, you heard me right, stocks that are climbing. I know this fly in the face of conventional wisdom of selling stocks as they fall further. However, our studies have clearly proven that stocks are more likely to fall in value after a period of up days than after a period of down days.

The third and final step is a combination of whittling the list down even further by looking for names whose 2-period RSI (RSI(2)) is greater than 97 (for additional information on this proven indicator click here) and the Stock PowerRating is 3 or lower.

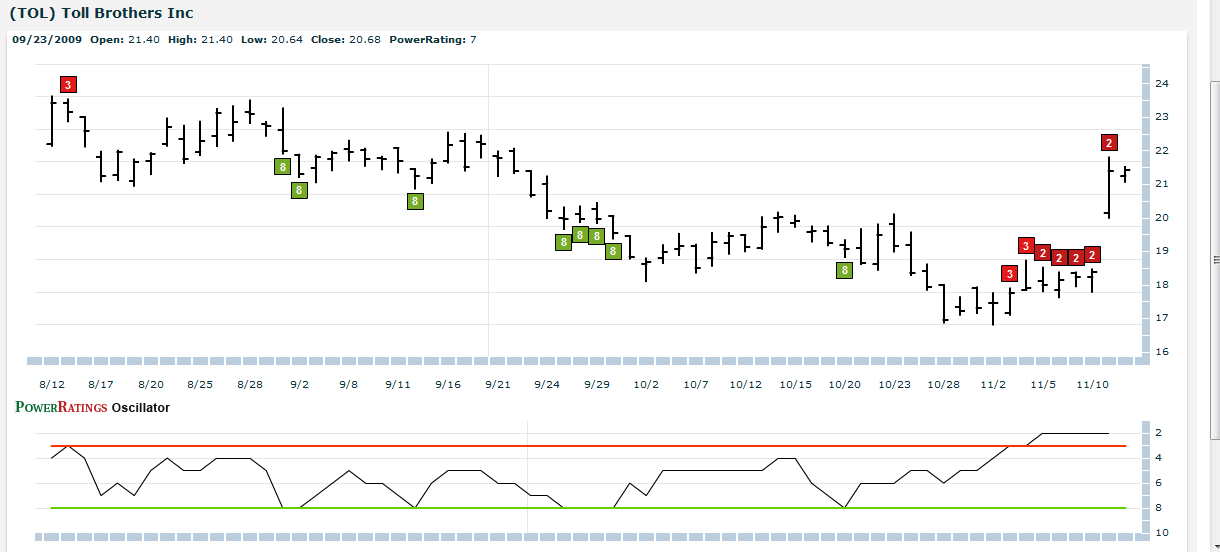

The Stock PowerRatings are a statistically based tool that is built upon 14 years of studies into the inner nature of stock prices. It ranks stocks on a scale of 1 to 10 with one being the most volatile and most likely for short term drops and 10 proven to be the most probable for gains over the next 5 days.

The stocks that fulfill each of the above steps have proven in extensive, statistically valid studies to possess solid odds of dropping in value over the 1 day, 2 day and 1 week time frame.

Here are 3 stocks ready to crack over the short term:

Force Protection

(

FRPT |

Quote |

Chart |

News |

PowerRating)

Cephalon

(

CEPH |

Quote |

Chart |

News |

PowerRating)

Toll Bros.

(

TOL |

Quote |

Chart |

News |

PowerRating)

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.