Dubai, Black Friday Double Entendres & 3 Uncaring PowerRatings Stocks

Black Friday is a true double entendre. Today, we may actually experience both meanings of the term. Dubai threatening default on billions in debt sent shockwaves throughout the world markets on the normally quiet Thanksgiving Day. Europe sold off hard and U.S. futures, while well off their lows, are still down substantially indicating sharp selling in the stock market. When markets sell off sharply, particularly on Friday, it is known as Black Friday.

Despite the selling, today is also a Black Friday of another sort. It is the start of the traditional Christmas shopping season. Called Black Friday as it is the day that retailers hope to turn a red losing year into the black or positive on the balance sheet.

Since there is not a direct, real time connection between consumer behavior and the stock market. We may see both a sharp sell off Black Friday and a successful Black Friday, start of the Christmas shopping season. Time will tell!

Fortunately, for short-term stock traders, it doesn’t really matter what happens in the overall market. Their mission is purely to locate stocks most likely to gain in the next 5 days. These stocks exist on crazy bullish up days, and Black Friday like down days. The trick has been locating these shares before they move higher.

Our studies, built upon a proprietary data base of millions of trades, have discovered a way to firmly place the odds in your favor when choosing stocks for short-term gains. An actionable, easy to follow 3 step system for locating these shares regardless of the underlying market bias has been the positive result of our extensive research. This article will explain the 3 steps and provide 3 stocks meeting the criteria for your consideration.

The first and most critical step is to only look at stocks trading above their 200-day Simple Moving Average. This assures that a strong, long term up trend is in place, increasing the odds that you are not buying into a falling knife or catching a stock in a death spiral.

The second step is to drill deeper into the list locating stocks that have fallen 5 or more days in a row or experienced 5 plus consecutive lower lows. Yes, you heard me right, fallen 5 or more days in a row. I know this fly in the face of conventional wisdom of buying stocks as they climb higher. However, our studies have clearly proven that stocks are more likely to increase in value after a period of down days than after a period of up days.

The third and final step is a combination of whittling the list down even further by looking for names whose 2-period RSI (RSI(2)) is less than 2 (for additional information on this proven indicator click here) and the Stock PowerRating is 8 or higher.

The Stock PowerRatings are a statistically based tool that is built upon 14 years of studies into the inner nature of stock prices. It ranks stocks on a scale of 1 to 10 with one being the most volatile and least likely for short term gains and 10 proven to be the most probable for gains over the next 5 days. In fact, 10 rated stocks have shown to have a 14.7 to 1 margin of outperforming the average stock in the short term.

The stocks that fulfill each of the above steps have proven in extensive, statistically valid studies to possess solid odds of increasing in value over the 1 day, 2 day and 1 week time frame.

Chicago Bridge & Iron

(

CBI |

Quote |

Chart |

News |

PowerRating)

Jefferies Group

(

JEF |

Quote |

Chart |

News |

PowerRating)

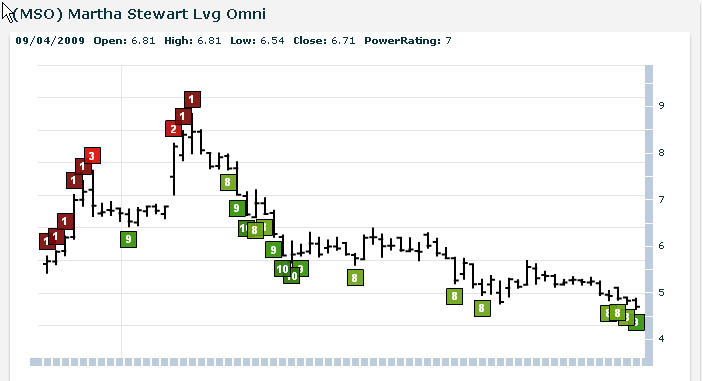

Martha Stewart

(

MSO |

Quote |

Chart |

News |

PowerRating)

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.