What Goes Up, Must Come Down: 3 PowerRatings Stocks Ready to Dip

What goes up, must come down, spinning wheel got to go round … these ancient lyrics are from the band, “Blood, Sweat & Tears”. Other then the obvious message of the song to just let things happen, it contains a bit of stock market wisdom.

If you have been reading this column, you know that it has been statistically proven that gains are more likely to occur after a pullback than after a run up in price. Well, the opposite is also true. Stocks have greater odds of falling back after a gain than to continue to gain. We have proven this fact in the short-term which is considered 1 to 5 days.

Shorting stocks can be a very rewarding trading method. I know this all sounds good in theory, but how does one go about putting it into practice? We have developed a simple 3 step plan to locate companies most likely to drop over the next 5 trading days. Remember, the stock market spinning wheel goes round and round, what goes up must come down!

The first and most critical step is to only look at stocks trading below their 200-day Simple Moving Average. This assures that the stock isn’t in a long term uptrend that may likely continue.

The second step is to drill deeper into the list locating stocks that have climbed 5 or more days in a row, experienced 5 plus consecutive higher highs, or are up 10% or more. Yes, you heard me right, stocks that are climbing. I know this doesn’t seem to make initial sense. However, our studies have clearly proven that stocks are more likely to fall in value after a period of up days than after a period of down days.

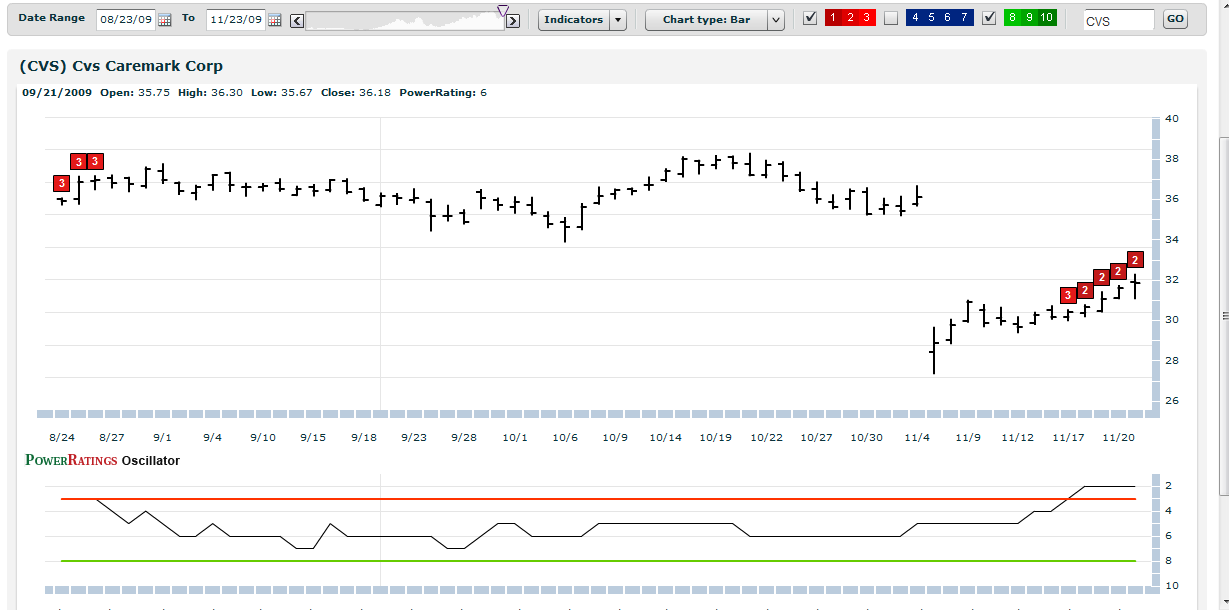

The third and final step is a combination of whittling the list down even further by looking for names whose 2-period RSI (RSI(2)) is greater than 97 (for additional information on this proven indicator click here) and the Stock PowerRating is 3 or lower.

The Stock PowerRatings are a statistically based tool that is built upon 14 years of studies into the inner nature of stock prices. It ranks stocks on a scale of 1 to 10 with one being the most volatile and most likely for short term drops and 10 proven to be the most probable for gains over the next 5 days.

The stocks that fulfill each of the above steps have proven in extensive, statistically valid studies to possess solid odds of dropping in value over the 1 day, 2 day and 1 week time frame.

Here are 3 names ready to dip after being higher:

Leap Wireless

(

LEAP |

Quote |

Chart |

News |

PowerRating)

CVS Caremark

(

CVS |

Quote |

Chart |

News |

PowerRating)

p>Cedar Fair

(

FUN |

Quote |

Chart |

News |

PowerRating)

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.