Names Ready for Gains: Friday’s PowerRatings Five Pack

This is one confusing and difficult to call stock market. Every day we are being bombarded with conflicting news stories. It almost seems like the major financial media promotes news that fits the market instead of the news driving the market. For example, this morning, super good earnings reports from several critical tech names and ultra positive housing data failed to prevent a stock market free fall in the first half of the session. Â Instead, the media focused on pessimistic forecasts from the rail road sector (of all places!) and stated that the strong home sales number was an aberration.

It’s my contention, had the market gone up, the major media would have not even mention the rail road forecast or that the housing numbers were an aberration. In other words, price drives news, news doesn’t drive price. This statement has its adherents and detractors but one thing is certain, short-term stock traders can not rely on news to make decisions as to what stocks to buy for short-term appreciation.

If one can’t rely on news for your stock choices, what can a short-term trader use to place the odds of success firmly in their favor? We have developed a simple 3 step plan that has been proven time and time again to produce companies that are most likely to outperform in the less than 5-day time frame. This article will lay out the easy to follow and understand steps as well as provide 5 names that fit the criteria for your consideration.

The first and most critical step is to only look at stocks trading above their 200-day simple moving average. This assures that a strong, long-term up trend is in place, increasing the odds that you are not buying into a falling knife or catching a stock in a death spiral.

The second step is to drill deeper into the list locating stocks that have fallen 5 or more days in a row or experienced 5 plus consecutive lower lows. Yes, you heard me right, fallen 5 or more days in a row. I know this fly in the face of conventional wisdom of buying stocks as they climb higher. However, our studies have clearly proven that stocks are more likely to increase in value after a period of down days than after a period of up days.

The third and final step is a combination of whittling the list down even further by looking for names whose 2-period RSI (RSI(2)) is less than 2 (For additional information on this proven indicator click here) and the Stock PowerRating is 8 or higher.

The Stock PowerRatings are a statistically based tool that is built upon 14 years of studies into the inner nature of stock prices. It ranks stocks on a scale of 1 to 10 with one being the most volatile and least likely for short term gains and 10 proven to be the most probable for gains over the next 5 days. In fact, 10 rated stocks have shown to have a 14.7 to 1 margin of outperforming the average stock in the short term.

The stocks that fulfill each of the above steps have proven in extensive, statistically valid studies to possess solid odds of increasing in value over the 1 day, 2 day and 1 week time frame.

Here is our Friday five pack of names ready for gains:

Cohen & Steers

(

CNS |

Quote |

Chart |

News |

PowerRating)

Greenhill & Co

(

GHL |

Quote |

Chart |

News |

PowerRating)

Modine Manufacturing

(

MOD |

Quote |

Chart |

News |

PowerRating)

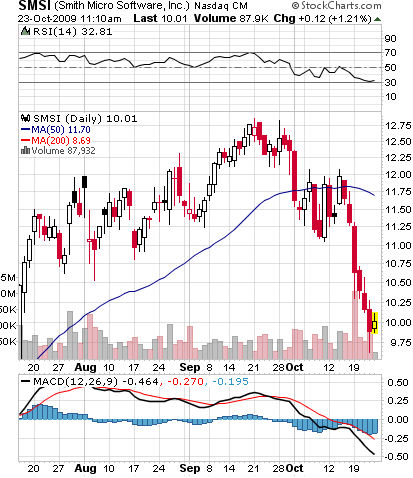

Smith Micro Software

(

SMSI |

Quote |

Chart |

News |

PowerRating)

Nextwave Wireless

(

WAVE |

Quote |

Chart |

News |

PowerRating)

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.