A Bear in the Bullpen: 3 Power Ratings Stocks Ready to Drop

You could see the nervousness on Phillies pitcher, Pedro Martinez’s face as he challenged Yankee’s MVP Matsui during the 6th game of the 2009 World Series. Martinez looked tired but still focused on the job of striking out as many Yankee players as possible to force a 7th game in the Series.

Obviously, something was wrong as he was unable to maintain his speed ball allowing Matsui to dominate the situation driving in winning runs. Should the Phillies coach have gone to the bullpen earlier to replace Martinez when it was clear he wasn’t on his “A” game? Would of, could of, and should of thoughts will haunt the Phillies for the foreseeable future.

I liken this situation to the stock market. Stocks are clearly overbought right now. Just like Martinez was obviously off his peak, stocks are aggressively overbought yet the market keeps going higher. Just like Martinez was kept in the game despite clear signs of being less than in ideal shape. The bulls are raging right now in the market. The time seems right to take the bear side in this pen of bulls.

How does one locate stocks that are primed to drop despite the overall market being wildly bullish? We have developed a simple 3 step plan to locate companies most likely to drop over the next 5 trading days. This article will focus on finding stocks that are primed for a short term decline. Remember, these same principles can be applied to taking profits from stocks, ready to drop, from your long portfolio.

The first and most critical step is to only look at stocks trading below their 200-day simple moving average. This assures that the stock isn’t in a long term uptrend that may likely continue.

The second step is to drill deeper into the list locating stocks that have climbed 5 or more days in a row, experienced 5 plus consecutive higher highs, or are up 10% or more. Yes, you heard me right, stocks that are climbing. I know this fly in the face of conventional wisdom of selling stocks as they fall further. However, our studies have clearly proven that stocks are more likely to fall in value after a period of up days than after a period of down days.

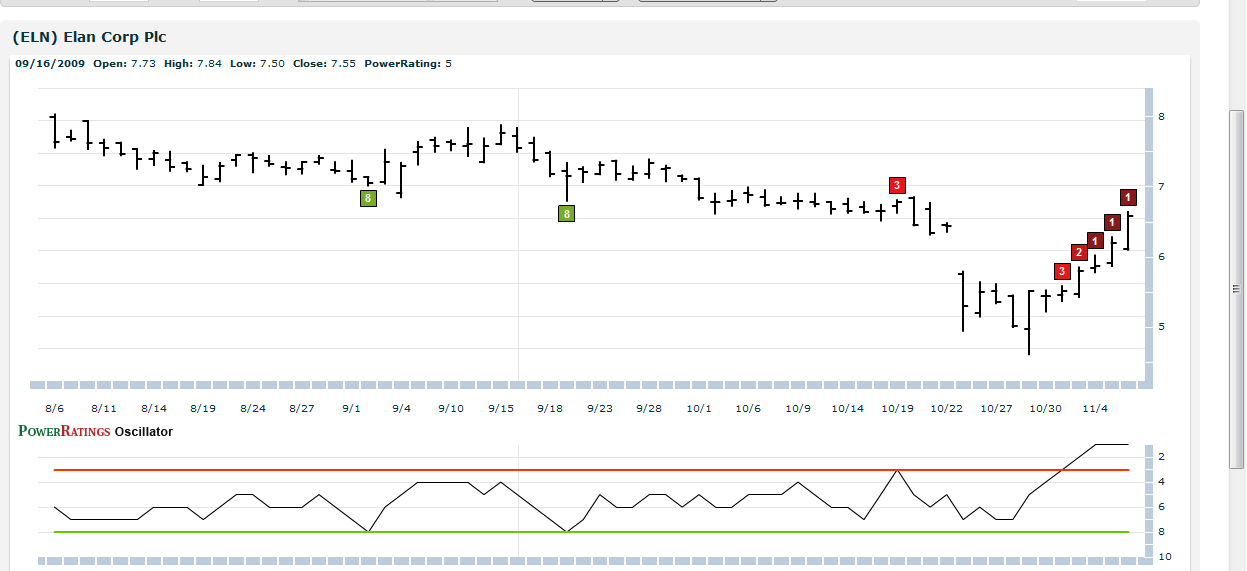

The third and final step is a combination of whittling the list down even further by looking for names whose 2-period RSI (RSI(2)) is greater than 97 (for additional information on this proven indicator click here) and the Stock PowerRating is 3 or lower.

The Stock PowerRatings are a statistically based tool that is built upon 14 years of studies into the inner nature of stock prices. It ranks stocks on a scale of 1 to 10 with one being the most volatile and most likely for short term drops and 10 proven to be the most probable for gains over the next 5 days.

The stocks that fulfill each of the above steps have proven in extensive, statistically valid studies to possess solid odds of dropping in value over the 1 day, 2 day and 1 week time frame.

Here are 3 potential bears in the bullpen for your consideration:

Elan Corp

(

ELN |

Quote |

Chart |

News |

PowerRating)

Lockheed Martin

(

LMT |

Quote |

Chart |

News |

PowerRating)

Wendy’s

(

WEN |

Quote |

Chart |

News |

PowerRating)

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.