Tricks of the VIX & 3 Top PowerRatings Stocks for Traders

Investors are always hearing about the VIX index in the financial news. However, many do not understand exactly what the VIX is and how to properly use it when making investment decisions. This article will provide a simple explanation of this often misused indicator, lay out simple tricks to use the VIX to your advantage, and provide 3 stocks poised for short term gains over the next 5 days.

The Volatility Index or VIX was first put into practice in 1993. It is built upon a paper written by Professor Robert Whaley. The index measures the implied volatility of the S&P 500 over the next 30 days. Specifically, it is a weighted blend of prices for a range of options on the S&P 500. These options are priced based on the expected volatility or price changes over the next 30 days.

In mathematical terms, the VIX is the square root of the par variance swap rate for the next 30 days. I know that’s a mouthful, an easy and useable way to think of it is the number represents the expected percentage move of the S&P 500 over the next 30 days on an annualized basis. This figure has been as low as 9% and as high as 89% since the VIX was started.

When markets drop the VIX usually climbs indicating fear represented by option prices. Climbing markets generally result in a lowering VIX as fear leaves the market and greed starts to take over. In fact, extreme VIX readings like witnessed in October, 2008, correspond with sharp sell offs.

Our extensive studies have clearly shown that the trick to using the VIX is not as a static number but rather where it is today relative to its 10 day moving average. What we discovered is called the VIX 5% Rule. Whenever the VIX is 5% below its 10 day moving average, the S&P 500 has lost money on a net basis 5 days following the times the VIX has been 5% below its 10 day moving average. This means be cautious buying stocks whenever the VIX is 5% below its moving average.

The opposite is also true. Whenever the VIX is 5% above its 10 day moving average, the S&P 500 has achieved returns that are better than 2 to 1 compared with the average weekly returns of all weeks.

As you can see, the VIX is a powerful tool when properly used.

Further information on using the VIX to help you make short term investment decisions can be found in Larry Connors’ seminal book, “Short Term Trading Strategies That Work”.

Here are 3 Power Ratings Stocks primed for short term gains:

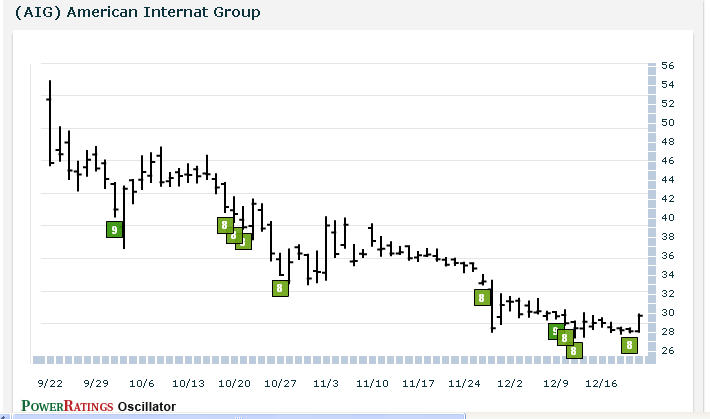

American International Group

(

AIG |

Quote |

Chart |

News |

PowerRating)

Perfect World Co

(

PWRD |

Quote |

Chart |

News |

PowerRating)

KMG Chemicals

(

KMGB |

Quote |

Chart |

News |

PowerRating)

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.