TradingMarkets Monday Movers: SPY, QQQQ, DIA

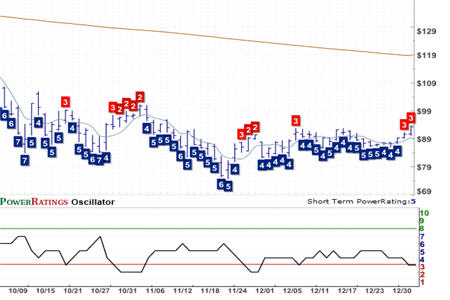

With stocks up for three days in a row going into Monday’s trading, more and more exchange-traded funds are moving into extreme overbought territory.

As mean reversion traders, who look to take advantage of markets as they become stretched beyond their normal trading behavior, this movement represents opportunity. We are less concerned about the potential for a January rally, or what a positive January might mean for the broader stock market. Instead, we take each day as it comes, measuring how far the day’s trading has pushed stocks or exchange-traded funds into extreme territory.

Want to take your trading to another level? Click here to find out more about Larry Connors’ new book, Short Term Trading Strategies That Work: A Quantified Guide to Trading Stocks and ETFs!

Our research tells us many things about stocks. But one of the most central is the fact that after stocks get stretched to the downside, they tend to bounce back. And after stocks and ETFs become overextended to the upside, the general tendency of those stocks and funds is to pull back or correct, before advancing again.

S&P 500 Index SPDRS ETF

(

SPY |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 3. RSI(2): 98.43

All of our work on short term trading in stocks and ETFs is based around this fundamental principle of stock and ETF price behavior in the short term. Our use of the VIX, our tactics with the 2-period RSI and most importantly, our strategies with Short Term PowerRatings all revolve around this key understanding of how stocks and ETFs really move.

PowerShares QQQ Trust ETF

(

QQQQ |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 3. RSI(2): 97.54

When stocks display high Short Term PowerRatings, they are signaling overstretch to the downside and potential opportunity to the upside. When stocks display low Short Term PowerRatings, then we know that stocks are likely overvalued. If we are looking to buy, then we are generally better off waiting for them to pull back. If we are looking to sell short, then these low Short Term PowerRatings stocks – especially those with Short Term PowerRatings of 1 – should be among the potential targets.

Diamonds Trust Series ETF

(

DIA |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 3. RSI(2): 98.73

Today, we have a very large number of 1-rated stocks relative to recent history. We also have virtually no stocks with Short Term PowerRatings of 8, 9 or 10. This tells us that stocks in general are very overbought in the short term. Traders looking to get long – either in the short term or as part of a strategy of taking positions in hopes of a larger, longer rally, may benefit from holding their fire until stocks and ETFs sell-off and move back from their current, overvalued, levels.

Does your stock trading need a tune-up? Our highest Short Term PowerRatings stocks have outperformed the average stock by a margin of nearly 17 to 1 after five days.

| Click here to start your free, 7-day trial to our Short Term PowerRatings! |

Whether you have a trading strategy of your own that could use a boost or are looking for a way to tell the stocks that will move higher in the short term from the stocks that are more likely to disappoint, our Short Term PowerRatings are based on more than a decade of quantified, backtested simulated stock trades involving millions of stocks between 1995 and 2007. Click the link above or call us at 888-484-8220, extension 1, and start your free trial today.

David Penn is Editor in Chief at TradingMarkets.com.