3 Top Low Priced PowerRatings Stocks for Traders: VLNC, DROOY, OCN

Looking for stocks you can buy in bunches? Here are three low priced, high PowerRatings stocks that are as attractive today as they were Wednesday morning.

When a stock has the same high PowerRating as it did yesterday, traders should pay special attention. Often, what has occurred was that the stock edged down even further. Not enough to cause the stock’s PowerRating to be upgraded by a point or two, but enough to bring the stock closer to the level at which our research shows they are best bought.

This level, by the way, is anywhere between 1% and 5% below the stock’s previous close. We call this buying on intraday weakness, and it is just one of the edges we have found in the short-term that stock traders should consider making a part of their trading methods and strategies.

Essentially, we are looking to take advantage of the “spillover” in pessimism into the following day, where traders become convinced that yesterday somehow controls today. This happens sometimes when the pre-market futures are trading lower, putting a negative pall over the first few hours of trading. Often the selling that occurs in these hours is selling that traders wish they had done yesterday. As a result, they often overdo it the following day, creating the sort of intraday weakness that can create incredible opportunities for traders confident to buy low and sell high.

For more simple and straightforward tips on short-term stock trading, consider getting a copy of our free report, written especially for those who trade stocks in the short-term “sweet spot” of five to eight days. Click here to get your copy of “5 Secrets to Short Term Stock Trading Success”–or call us at 888-484-8220–and see what the TradingMarkets approach to trading can do to make you a better trader.

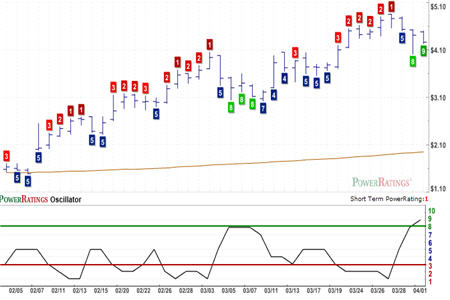

The three stocks in today’s report all have lofty Short Term PowerRatings. One of the stocks, Valence Technology

(

VLNC |

Quote |

Chart |

News |

PowerRating) has a Short Term PowerRating 9. Our research, involving millions of simulated stock trades from 1995 to 2007, suggests that stocks with Short Term PowerRatings of 9 have outperformed the average stock by more than 13 to 1.

Valence Technology, in addition to having a Short Term PowerRating of 9, also has a 2-period RSI of 15.09.

The other two stocks I want to mention today are DRDGold Ltd.

(

DROOY |

Quote |

Chart |

News |

PowerRating) and Ocwen Financial

(

OCN |

Quote |

Chart |

News |

PowerRating). Both of these stocks have Short Term PowerRatings of 8. This means that while these two stocks may not have the same upside as Valence Technology, they are still part of that class of stocks that short-term traders want to be looking for when the time to buy pullbacks arrives.

DRDGold Ltd. Has a 2-period RSI of 54.95. The stock’s RSI exploded to the upside today on the back of a very bullish session for DROOY. Yesterday, on Monday, DROOY had a 2-period RSI of merely 6.32.

Ocwen Financial, our other 8-rated stock, is an interesting case because the stock is trading below its 200-day moving average. I wanted to note the stock because of its low dollar price and its excellent Short Term PowerRating. But as long as the major markets remain under pressure, with their most recent closes still below the 200-day moving average, stocks like Ocwen Financial may be better for watching than for trading at this time. The stock has a 2-period RSI of 2.21.

David Penn is Senior Editor at TradingMarkets.com.