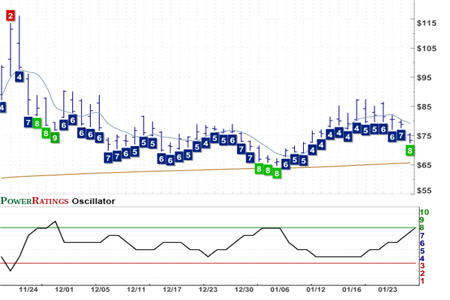

The Short Side: High PowerRating Inverse ETFs for Traders

Profit-taking has characterized the first hour or so of trading on Thursday as the overbought conditions created over the past few days have provided traders with the opportunity to take in gains from speculative trades to the upside.

The current market also provides opportunity for traders to wager that the current correction in stock might last for more than a day.

Our top 25 PowerRatings Stocks roster as of the Wednesday’s close was completely overrun with short/inverse exchange-traded funds. These exchange-traded funds not only allow traders to buy, sell and sell short whole sectors, markets or country indexes. Short/inverse ETFs also allow traders to bet on falling prices in these sectors, markets or country indexes without having to go through the trouble of borrowing shares in order to sell short.

More than this, a wide number of short/inverse ETFs are leveraged two-to-one or even three-to-one. This means, for example, that for every point lower the S&P 500 moves, the ProShares UltraShort S&P 500 ETF, SDS

(

SDS |

Quote |

Chart |

News |

PowerRating) will move twice as much to the upside. (Note that SDS has a Short Term PowerRating of 8 and a 2-period RSI of 3.88.

ProShares UltraShort QQQ ETF, QID

(

QID |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 8. RSI(2): 3.68

The variety of short/inverse ETFs is impressive, allowing traders to look for those markets that have the highest Short Term PowerRatings and the lowest, 2-period RSI values. These are the opportunities that are likely to have the greatest edges for short term ETF traders looking to buy ETFs on sale and to sell them as their value becomes recognized by the rest of the market.

ProShares UltraShort Russell 2000 ETF, TWM

(

TWM |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 8. RSI(2): 5.23

As with Short Term PowerRatings for stocks, traders using our Short Term PowerRatings for spotting the best short/inverse ETF trades can follow many of the same steps. Look for the highest Short Term PowerRatings short/inverse ETFs, with the lowest 2-period RSIs and consider relying on intraday weakness to help establish the lowest possible position in the ETF trade of your choice. Do this by using limit orders below the previous low and waiting for sellers to “deliver” the ETF to you.

Does your stock trading need a tune-up? Our highest Short Term PowerRatings stocks have outperformed the average stock by a margin of nearly 17 to 1 after five days.

| Click here to start your free, 7-day trial to our Short Term PowerRatings! |

Whether you have a trading strategy of your own that could use a boost or are looking for a way to tell the stocks that will move higher in the short term from the stocks that are more likely to disappoint, our Short Term PowerRatings are based on more than a decade of quantified, backtested simulated stock trades involving millions of stocks between 1995 and 2007. Click the link above or call us at 888-484-8220, extension 1, and start your free trial today.

David Penn is Editor in Chief at TradingMarkets.com.