ETF Trading Strategies: Bargains in Bonds and Bullion

Whoever said that oversold conditions below the 200-day moving average tend to become even more oversold must have had Monday’s market in mind at the time.

Stocks ended last week very oversold and traders have continued to press their bearish bets on Friday. With an hour’s worth of trading done, the Dow Industrials, S&P 500 and Nasdaq Composite are all down more than 1%, with the Dow and S&P 500 far closer to being down 2%.

So where can short term traders look for opportunities among the selling? One of the best trading strategies for stock traders and ETF traders during oversold conditions is to look for those stocks or ETFs that continue to trade above their 200-day moving averages, yet have pulled back significantly from their highs.

While strong selling pressure can wreak major damage to stocks and ETFs that are trading below the 200-day moving average, selling pressure can help the right stocks fall right into the trading strategy of short term traders who buy weakness and sell strength.

In the ETF world, the vast majority of sector, index and country ETFs are trading below their 200-day moving averages. However there are a few ETFs based on fixed income products like bonds and commodities that have continued to trend above their 200-day moving averages. As these bond and commodity ETFs pullback, they create potential opportunities for traders looking to pick up ETFs that have been put on sale by profit-taking.

With regard to bond ETFs, we have the iShares Barclays Aggressive Bond Fund ETF

(

AGG |

Quote |

Chart |

News |

PowerRating) and the iShares Barclay’s 20+ Year Treasury Bond Fund ETF

(

TLT |

Quote |

Chart |

News |

PowerRating). AGG has a Short Term PowerRating of 6 and a 2-period RSI of 11.54. TLT also has a Short Term PowerRating of 6, but has an even lower 2-period RSI of 6.57.

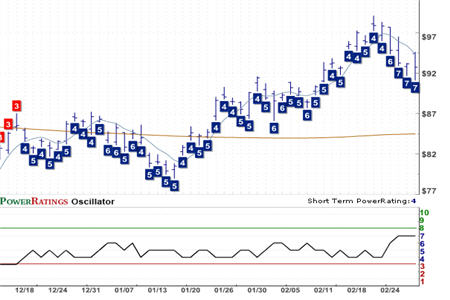

As for oversold commodity ETFs, the SPDR Gold Shares ETF

(

GLD |

Quote |

Chart |

News |

PowerRating) has a Short Term PowerRating of 7 and a 2-period RSI of 6.53. The GLD was down for three out of the past four days and four out of the past six since making a top on February 20.

Generally speaking, while the 2-period RSIs on these ETFs are well in the oversold range, we like to see ETFs – like stocks – earn Short Term PowerRatings of at least an 8. Keep an eye on these three ETFs. Further weakness could provide these ETFs with the sort of PowerRating upgrades that has historically signaled opportunity to the upside.

We have found ETF trading strategies that rely on buying oversold ETFs and selling them as they become overbought to have been among the more successful ways to trade ETFs in this or any environment. Trading ETFs has a number of advantages over trading stocks — from avoiding corporate risk to the reduced volatility — and more and more short term traders are turning away from stocks and toward exchange-traded funds as their preferred trading vehicles.

If you are thinking about making the move to ETF trading, then be sure to sign up for Larry Connors’ High Probability ETF Trading Seminars on Tuesday, March 3 and Wednesday, March 11. These free, registration-only events will show you how easy it is to trade ETFs using quantified, backtested trading strategies that have produced simulated winning trades up to 90% of the time.

Click here for more information.

David Penn is Editor in Chief at TradingMarkets.com.