ETF Trading Strategies: How to Exit an ETF Trade

Our approach to taking positions in ETFs is to wait for ETFs to reach extreme levels of being overbought below the 200-day moving average or oversold above the 200-day moving average. In the first instance of overbought ETFs, we are looking to sell short. In the second instance of oversold ETFs, we are looking to buy.

For a refresher on overbought and oversold conditions in ETF trading, click here.

Materials Select Sector SPDRS ETF – XLB: One of the best ways to trade mean reverting markets like ETFs is to buy when the markets are weak and to sell when the markets recover and are strong again.

This approach to ETF trading is a mean reversion based trading strategy. Our testing, which goes back to the mid-1990s in the SPDRS S&P 500 ETF or

(

SPY |

Quote |

Chart |

News |

PowerRating) and since inception for most other liquid ETFs, shows us that exchange-traded funds, just like stocks, have a tendency to revert back toward their mean or average levels after becoming extended or stretched from those levels.

In other words, an uptrending ETF or an ETF trading above its 200-day moving average that pulls back is likely to resume its uptrend, or at least rally in the short term, once that pull back has run its course. Conversely, a downtrending ETF or one that is trading below its 200-day moving average that bounces is likely to return to its downward trajectory or, at a minimum correct further, after its temporary rally is over.

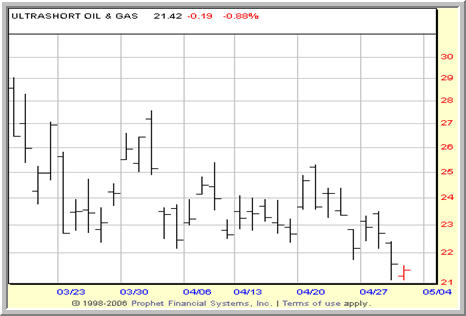

ProShares UltraShort Oil & Gas ETF – DUG: When selling ETFs short, we look to short or sell strength and buy (or cover) on weakness. It is the same “buy strength, sell weakness” principle in action as when we are buying ETFs.

But once we’ve taken a position in an ETF – either by buying an oversold ETF above the 200-day or selling short an overbought ETF below the 200-day – how do you know when to exit?

Our ETF trading strategies do not just provide high probability, high win-rate trades. They are also very simple and straightforward because they rely on a single, time-tested principle that has proven to provide an edge for traders trading in the short term: buy weakness and sell strength.

This principle extends to our strategy when it comes to exiting ETF positions. If we buy on weakness, then we are looking to exit on strength. If we sell short on strength, then we are looking to exit (or cover) our position on weakness.

Click here to continue to Part 2 of How to Exit an ETF Trade, where we will look at some of the basic ways that short term ETF traders can exit ETF trades using both short term highs or lows as well as the 2-period RSI. Then, in part 3, we will conclude with our favorite exit strategy for both exchange-traded funds and stocks.

Did you know that our PowerRatings work for exchange-traded funds too? If you’ve been looking for help in trading ETFs in both bull and bear markets, then our ETF PowerRatings may provide the solution you are looking for. Click here to start your free, 7-day trial today!

David Penn is Editor in Chief at TradingMarkets.com.