Popular Sentiment Indicators And How I Use Them

At the end of

1999 and the beginning of 2000, the Nasdaq was cooking. Biotechs,

Internets and Technology

seemingly

could not be stopped. Bullishness in the market was

running rampant. Investors’ expectations were sky-high and rising. Analysts had

recommendations with targets of four figures. Newsletter writers were telling

you to back up the truck.

Fast forward to

February

2001. The Dow and S&P 500

had

sustained

intermediate-term

corrections. The Nasdaq was

down a whopping 53% from its March 2000 high. Many

famous tech names

were down more than 70% and a bunch of Internets

had already

said bye-bye.

You would have expected

them

to have much less optimism in the markets. In

fact, you would expect downright pessimism.

But

these talking

bulls hadn’t budged.

One of the most popular gauges of sentiment and my favorite comes from a company

called Investors Intelligence. This company tracks newsletter writers.

Many years back, Investors Intelligence decided to follow these writers’

opinions in order to decipher which way the market was headed. They figured that

if all these writers were bullish, it would be a good sign to be in the market.

Were they in for a surprise? After years of study, they found the polar opposite

was true. It turned out that these writers were trend followers and would only

turn bullish or bearish after the move.

Thus,

I consider the

bullish newsletter number a great contrarian indicator. In

the past, when optimism

has gone

to extremes, it

often

preceded market tops. When

pessimism hit extremes, it

often

signaled a bottom. While 55% bulls would

appear

to me to be

a

worrisome number, 35% bulls would

be time

to consider buying. Most people believe

it is a mistake to

watch

these numbers. I disagree. While I will

always believe market action holds the most weight, when these numbers go to

extremes, they have worked quite well for me as a secondary indicator

of

where the market cycle might be.

Here are some facts to chew on:

-

Throughout the major

drop of

March 2000

until February 2001, the

newsletter

writers

stayed steadfastly bullish.

At

the beginning of February 2001, and not so coincidentally after the move up,

the bulls hit

61.8%,

which is a 14-year high.

I

viewed

this as a worrisome number.

- In 1994, just before the market

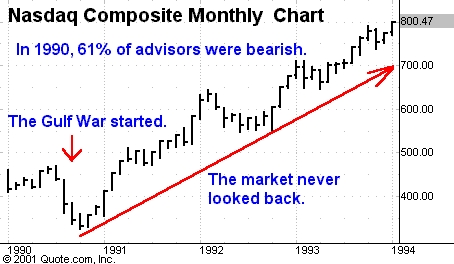

kicked into gear, bearish sentiment hit 59%. - In 1990, during the recession, more

than 55% of the advisors were bearish. The Gulf War started and the market

never looked back. - In 1987, 61% of advisors were

bullish all the way into October. I don’t think I have to refresh your

memory as to what happened next.

These are just a few moments in

history when these numbers went to extremes. Keep in mind, these extremes do not

happen very often. I urge you to start paying close attention to this indicator,

as it has

been

very uncanny when

extremes have occurred.

You can find this number every day on the market page of Investor’s Business

Daily.

Look for my next report where I will discuss put/call ratios, magazine covers,

short interest and other sentiment indicators.

Here For A Free 1-Week Trial To Gary Kaltbaum’s Intra-Day Alerts Service