These Trades Are Working Now

Long-time readers know

that my #1 Rule is to trade with trend. The trend being defined by

the slope of the 20 period moving average on a 1-minute chart. However, like

all things in life rules can and need to be broken in order to make headway, or

in our case; profits.

I have mentioned in recent articles that I have

doing a lot of Fade the Gap type trades

lately. These trades are completely counter-trend. What I have been a bit lax

on is reviewing the characteristics of these trades so that it is more clear to

everyone. Since it is not mentioned in my book, it deserves some attention,

rather than the a simple “Hey, these trades worked great yesterday.”

Let’s go back and take a look at the trades I

mentioned in Friday’s article, Fade the Gap

and Rubber Band trades.

Fade the Gap originated from the price action

that occurred when a stock opened far above/below the previous day’s closing

price. The logic was that all stocks, like most things in life, when out of

equilibrium will, to some extend, regress back towards a central point, call

reversion to the mean. Similar to the way a rubber band goes back to its’

original shape when stretched too far. A specialist will typically open a stock

at a price where he/she believes is the present “equilibrium price” and where

there is the greatest possibility of the stock moving back in the opposite

direction. Remember, a specialist needs to take the other side of a trade, so

when there is large buying/selling interest on the opening, they are on the

other side. Naturally if the specialist is selling stock to all the buyers on

the opening (getting short), he/she are betting that the opening price will be

pretty close to the top print for that time, and they will profit from any move

lower. The opposite applies when the specialist has to be the buyer when

confronted with a bunch of sell orders on the opening.

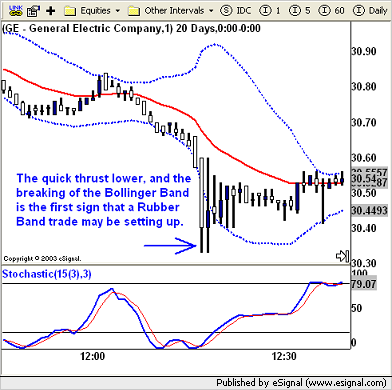

While these trades are easily identified on the

opening, they can occur during the trading day as well. Again, it is really

just a function of a stock falling/rising in a rapid manner as well as it

losing/gaining a lot of ground in that time.

Both of these trades combine two skill sets:

1. Your ability to determine if the stock is

overbought/oversold as defined by the stochastics.

2. Tape reading

You need Step 1 to be verified before you can

proceed to Step 2. Step 2 is the most critical. There are no books on it and

proficiency in it comes from old fashioned staring and repetition, something

most traders never choose to do. Simply buying or selling a stock cause it is

oversold can be costly. Tape reading really boils down to observing price

action and trying to determine when the price is about to make that

counter-trend move. The common things I look for are bids or offers that do not

go away despite lots of trades occurring at that price or simply showing

up-ticks on large volume in the opposite direction. Again, it is an art, but

can be learned. The most accomplished traders in my

Trading Room are those who understood from day 1 that it was going to

take a month or two of observing a handful of stocks before they could really

have that level of understanding that allowed for anticipation rather than

reaction. Believe it or not, knowing when to pull the trigger on just about any

trade set-up comes from the gut, the synthesis of your technical abilities and

your ability to have focused on tape reading, it really becomes a sub-conscious

understanding, as it should. The market cannot be boiled down to a standard set

of rules in order to be successful. Rules, as mentioned above, are a

requirement, but really a small piece. The market consists of humans making

decisions based on fear and greed, you cannot quantify that fully with standard

technical analysis. It is your job to be able to dig deeper and use your skills

in observation in order to make a decision as to what is really going on. This

is the heart of knowing when to execute a Fade the Gap

/ Rubber Band Trade.

The Altria

(MO) trade as you see was the one that really required tape reading. For

several bars the stochastics remained oversold, yet the price action grinded

lower, a costly mistake for a trader relying solely on technicals. The only

thing that allowed for the proper entry here was tape reading.

As we all know the market is demanding, now more

than ever. The forgiving intra-day volatility of years ago is gone, there are

trades each and everyday, you just need to have the patience and skill set to

take advantage of them. remember, trading is a marathon, not a sprint.

As always, feel free to send me your comments and

questions.