It’s A Matter Of When, Not If…

With

the rhetoric increasing from the BoJ regarding the movements in the

FX markets, one has to eventually concede that it is simply a matter of when,

not if, they will intervene. The timing of their comments is quite interesting,

at least from a technical standpoint.

Â

Japan Finance Minister

Tanigaki:Â “We will act

timely and aggressively if the currency market moves in a manner out of line

with fundamentals. Foreign exchange rates should reflect fundamentals and

companies take this into consideration.”

While there is no rhetoric from

the SNB at present regarding the movement of their currency, the technical

backdrop of the Swiss Franc is also compelling.

Â

Technical Notes:

EUR/USD:Â short-term support at

1.2900-1.2905 continues with 1.2930 ready to cap any moves higher.Â

Consolidation appears likely with FOMC and many speculative longs nervously

hanging on. Also look for 1.2843 to act as support if 1.2900 gives way.

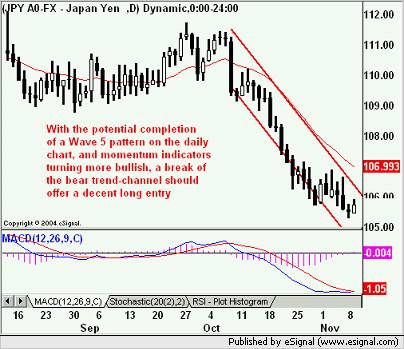

USD/JPY:Â support seen at

105.55 with 105.86 and 106.10 acting as resistance. A close above 106.10 should

allow for a move towards 106.66 and 106.90.

GBP/USD:Â narrow consolidation

with slight upside bias. 1.8557 and 1.8600 are key resistance levels. Support

seen at 1.8500 and 1.8476

USD/CHF:Â range compression and

oversold conditions make this one posied for a move higher if the dollar shakes

off all the negativity surrounding it. The FOMC or economic data might just be

the catalyst. It appears that 1.1945-1.1966 will the be the areas that needs to

be cleared to suggest higher levels. Support seen at 1.1805 and 1.1965

AUD/USD & NZD/USD:Â short-term

models suggest sidelines for now as recent gains are digested.

As always, feel free to send me

your comments and questions.

Â

Â