Defensive Strategies For Buying Stocks In An Overbought Environment

After

a sharp pullback on Friday, the market spent the day trying to

reassert its uptrend. Did anyone think a nice little 3-4 day pullback to

support levels was in the works? I hope not if you’d read my columns from last

week. Speaking of which…in last Wednesday’s column I suggested using defensive

strategies when purchasing stocks in an overbought environment. Afterwards I

received s a few emails asking me for an example.

Â

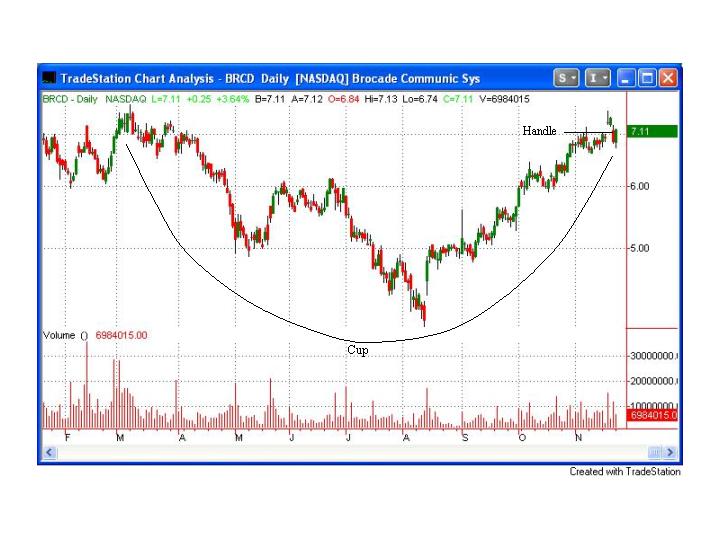

Here’s an example from

Wednesday. After forming a low level cup and handle base, Brocade (BRCD) gapped

up above its pivot point. For those hoping to get in on the breakout, one way

to do it would have been to buy the first intraday pullback. If you’re using

5-minute bars, this would have happened around 10:15. If you’re using 15-minute

bars, 11:15 was the low of the first pullback.

Â

Â

If you’re trading breakouts

defensively, that means you’re insisting on only keeping the best breakouts. If

a breakout isn’t successful right away, get rid of it. Regardless of where my

initial stop was placed, I would be exiting BRCD at the end of the day as it

failed to follow through and close well (about a $0.10-$0.15 loss). Closing at

the bottom of its range, especially on a day where the market was strong, is a

sign that the stock isn’t ready to explode higher. When expecting a market

pullback, I believe it’s better just to cut you’re losses and wait for the next

opportunity. In BRCD’s case, an intermediate-term stop just above the low of

the original handle may turn out fine, but I didn’t think it was appropriate in

an overbought environment.

Â

So why buy any breakout in an

overbought environment? Well, the best ones many times will work right away,

and the potential rewards make taking small risks well worth it. Look at NGPS

which broke out last Monday when many traders were expecting a market pullback –

a very strong breakout followed by a mild two day pullback and a strong continuation

upwards.Â

Â

Â

You wouldn’t have wanted to

pass on that one because you felt the market was short-term overextended…

Â

Best of luck with your trading,

Â

Rob Hanna

Â

Â

Â

Â