How far could the current rally go?

Oftentimes it is helpful to look at

longer-term charts in order to determine future levels of resistance and find

possible price objectives. Evaluating the long-term charts of the S&P

500, the NASDAQ Composite, and the Dow Jones Industrials may give us a clue as

to where this current rally could go.

If you use regular line charts, bar charts, or candlesticks,

you would just change your view from daily to weekly and then to monthly. In the

point and figure method, you just change the box size in order to see

information for a longer time period, and, in order to see where possible

resistance could be.

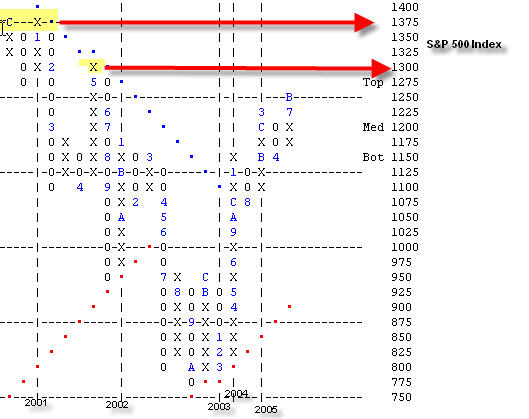

Below is the point and figure chart of the S&P 500 Index using

a 25-point box (still a three box reversal). Just this past month the S&P broke

through resistance at 1225 and now there is no other resistance until 1300. Even

that resistance does not seem too formidable, as it currently would just take a

double top breakout for the market to move through it.

The next level of resistance for the S&P is 1375 and that

could prove to be quite formidable as the market will have to break a triple top

(at least) in order to get through it. I say “currently†and “at least†because

the chart could have more movement back and forth before we approach the 1300

level that could cause the resistance at 1300 to seem more formidable and also

at 1375. Those levels are just the next two on which to keep your eyes peeled.

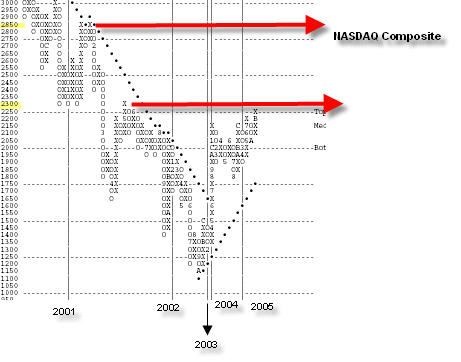

The next chart is the 50-point chart of the NASDAQ Composite. In order to see

the next two points of resistance with clarity, you should view this chart back

to 2000. The first level that could be a problem is 2300. There is one point of

resistance, but there is also some significant support that was formed at this

level in 2000 and 2001. Oftentimes former support will and does become future

resistance as it did one time before as evidence by the failure of the index to

go further in May of 2001. The next level that could serve as resistance is

2850. There is already some congestion formed there (a double top).

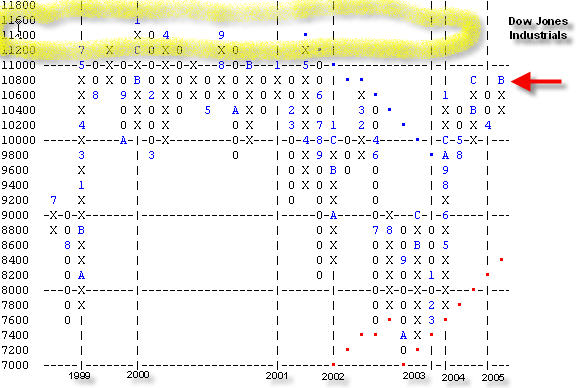

What follows is the 200-point chart of the Dow Jones

(

DJX |

Quote |

Chart |

News |

PowerRating). I could see the

next resistance the most easily on this chart. Currently, we are at resistance

at 10800. The Dow has been a laggard, and the market as a whole may need the

breakout to 11000 to continue the rally. I, personally, don’t think that that

needs to happen because of the Dow’s past inability to lead, and, because it is

not moving in concert with the Transports. This, of course, if you are a Dow

Theorist, could lead you to believe that the current rally is on a slippery

slope.

However, there is enough evidence in the bullish camp that

suggests that investors still need to participate here. As you can see looking

at the chart, there is a lot of overhead congestion beginning at 1120. The

congestion on this chart increases the validity of the hypothesis that investors

should be concentrating on mid to small cap stocks and that sector concentration

and rotation will continue to be the way to prosper. It also serves as evidence

to discourage investment in exchange traded funds that follow the Dow.

Â

Sara Conway is a

registered representative at a well-known national firm. Her duties

involve managing money for affluent individuals on a discretionary basis.

Currently, she manages about $150 million using various tools of technical

analysis. Mrs. Conway is pursuing her Chartered Market Technician (CMT)

designation and is in the final leg of that pursuit. She uses the Point and

Figure Method as the basis for most of her investment and trading decisions, and

invests based on mostly intermediate and long-term trends. Mrs. Conway

graduated magna cum laude from East Carolina University with a BSBA in finance.