If the S&P hits this level today..sell

Stock index futures were more directional

in nature than we’ve seen for a bit lately. That said, it was still a

modest range day on rather normal volume. Most of the September index option

contracts cease trading tonight and settle off tomorrow’s average opening value.

That tends to skew expiry Thursday’s index action a bit, but not always. Could

be an eventful day ahead… and here are some overall points of reference to

heed:

ES (+$50 per index point)

S&P 500 has (at least) three visible swings

from the past three sessions. Laying retracement grids on each shows 1238 as

triple resistance and 1241 ~ 1242.50 a dual zone of upper resistance as well.

With this in mind, sell signals near these zones are high-odds entries to

perform.

Overall, the past four complete sessions have

seen a 16pt total decline in the S&P. That is nothing to get excited about, and

certainly not extended to the downside. Further selling is possible, path of

least resistance appears to be lower.

MD (+$100 per index point)

S&P 400 has initial resistance near 719 and dual

layers of resistance near the 720.50 level. Total range for the MD was 6+ points

or $600+ per contract. Not a big session by any stretch, but tradable.

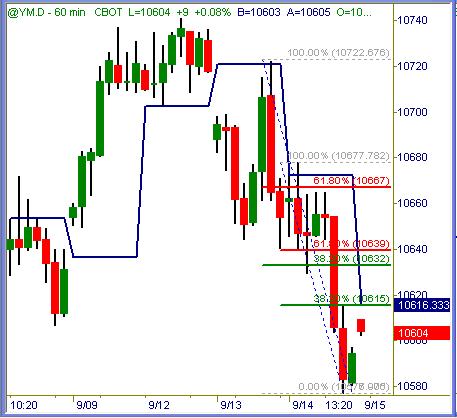

YM (+$5 per index point)

Dow Industrial futures face initial

resistance near 10615 and heavier layers near 10630. Yesterday’s sell signal

near 10670 was good for +$450 per contract if held to the lows, or some measure

of profit in between if closed early. Today could be equally prosperous if not

more so.

ER (+$100 per index point)

Russell 2000 futures have mapped the

steepest decline of any stock index recently. Hot money flies in, hot money

pours out accordingly. First resistance is 673.80 followed by 676 area of

layered overhead. Sell signals near these zones of clustered congestion are

high-odds to work.

{Price levels posted in charts above are

compiled from a number of different measurements. Over the course of time we

will see these varying levels magnetize = repel price action consistently}

Power Of Thought

“By your words (thoughts) are ye justified, and by your words

(thoughts) are ye condemned.”

I can almost always tell when a person is going

to succeed or fail at any endeavor in life purely from what they expect.

Positive expectations matched with perfect practice equals eventual success.

Negative expectations matched with half-baked, slipshod practice habits leads to

inevitable failure.

Thoughts and actions necessary to succeed

inside any endeavor are

no more difficult than thoughts and actions necessary to fail. Why do so many

traders choose to walk the losing path thru our profession?

Impossible Odds?

There are thirty-two teams of professional football players in the National

Football League. One of those teams will win the SuperBowl championship prize

for this season’s long, grueling process.

The odds of any single team winning at random

are 3.1% out of 100%.

Literally thousands of college players each

year vie for a spot on each team’s roster, with random odds of success being

considerably less than 3.1% in favor.

Time, effort, study and individual sacrifice

made on so many levels to first reach the NFL as a player and then win a

championship are astounding and infinitesimal in my mind. What it must take from

start to finish thru literally years and usually decades of focus and

goal-setting is (in my opinion) far beyond that of succeeding as a profitable

trader.

Where would any of those players be if they

began playing Pop Warner, high school or college ball with the following

internal dialogues?

“I’m so busy with college work, I don’t have

time to study the playbook”

“Every time I try to catch the ball, I drop it. Stupid Quarterback throws

wildly”

“Every time I try to tackle someone, they run the other way. The game is out to

get me”

“Playing in the NFL is just too hard. I don’t have the patience to learn &

practice”

“The majority of players who try will fail. It is a sucker’s bet to even dare

dream”

“I’ve played soccer for years. Just give me NFL basics and I’m ready to turn pro

asap”

“I need to play NFL football right now… I just quit my job to go full-time”

“I don’t have time to learn… must make money as an NFL player from day one”

“There must be some secret formula = system that will teach me how to play from

day one”

“I need a system that shows me where to run, catch the ball or tackle correctly

every time”

“I can just join a team, follow the head coach and earn while I learn.

Meanwhile, I can workout and lift weights to grow from present 6’2″ and 160lbs

to a full-size running back’s condition. I’ve never lifted weights or run wind

sprints before… but how hard can that be?”

Get What You Expect

Replace the inner dialogues that float thru most football player’s minds

listed above with a slight change in wording, and you have the exact-same

affirmations of failure for aspiring traders.

It is widely touted that most traders fail to

make money and wash out of our profession. Yeah, and what else is new? How many

aspiring athletes achieve pro status? How many aspiring actors / actresses

support themselves full-time? How many communications majors in college secure

news anchor or investigative reporter roles? How many vice presidents of

corporations ever reach C.E.O. status? What profession, especially a high-paying

one does have an easy barrier of entry to success? None that I can think of.

Just because anyone can fund an account and

call themselves a trader does not mean they have reached step one in the

necessary training curve. Any walk-on in college can call himself a football

player… surviving the practice sessions to reach live game action is another

story.

Along the way in life, our own mind is the

point of make or break for success and failure alike. We know that the power of

positive thinking is paramount for success. You would not want to root for any

athlete or professional team that expects to lose. You would not want your

spouse, child or anyone you love to walk around planning their own failure by

repeating negative thoughts to themselves.

Why then do so many of us persist in thinking =

speaking negatively? We’ll continue our discussion on Friday.

Trade To Win

Austin P

(free pivot point calculator, much more inside)

Austin Passamonte is a full-time

professional trader who specializes in E-mini stock index futures, equity

options and commodity markets.

Mr. Passamonte’s trading approach uses proprietary chart patterns found on an

intraday basis. Austin trades privately in the Finger Lakes region of New York.