Why I have an upward bias, until proven otherwise

Pre-market futures are mostly unchanged

from Friday’s close, which was in itself mostly unchanged from price levels at

noon on Friday. Bias is upward until proven otherwise, with layers of support

identified below:

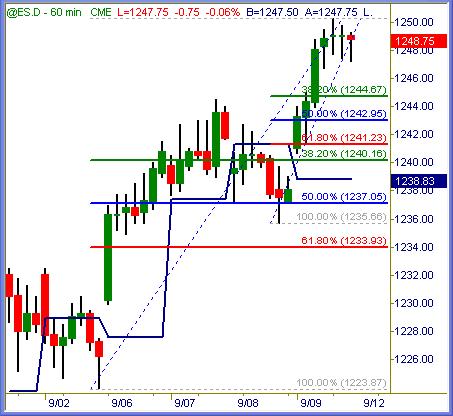

ES (+$50 per index point)

S&P 500 worked its way higher Friday morning

and flattened out from noon to the closing bell. Initial layers of support are

in the 1244 zone with clustered support near 1241 area. Still bullish until

proven otherwise as the most recent break of congestion worked its way slightly

higher.

Year 2005 highs near 1255 are just a heartbeat

away from being tested again. That followed a terrorist attack in London, while

Katrina’s unprecedented dollar-cost damage is the latest market dip for bulls to

buy. Should be an interesting reaction is 1255 is hit, and that will most likely

happen real soon.

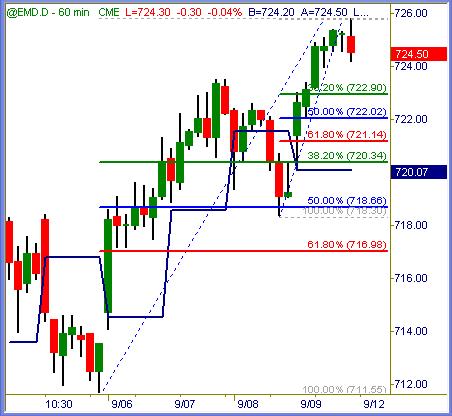

MD (+$100 per index point)

S&P 400 sees initial support around 722.90 and

congested layers near 721 ~ 722 just below there. Bullish above 721 and bearish

below 720 would be the overall bias heading into today. Only a whisper away from

all-time highs of 731+ posted this summer, as Midcaps found support near the 700

level and walked upwards from there.

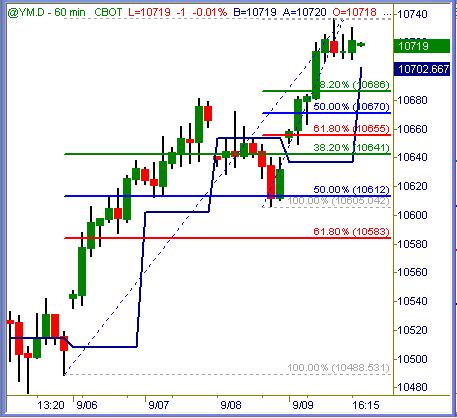

YM (+$5 per index point)

Dow Industrial futures are not joining the

love fest over in S&P-land. Current 10,700 is roughly -400 index points below

current yearly high, and 10,800 is the site of numerous recent highs that soon

dropped to swing lows shortly after.

10680 and 10650 are the zones of support for

today’s pending session.

ER (+$100 per index point)

Russell 2000 futures are likewise 13 index

points from testing calendar year highs again. Layers of short-term support

below should hold first tests today.

{Price levels posted in charts above are

compiled from a number of different measurements. Over the course of time we

will see these varying levels magnetize = repel price action consistently}

New System

My beloved Miami Dolphins (fan since January 1971… yes, that long

ago) won their first game this season in convincing fashion. To read the summary

stats would lead one to believe they are playoff contenders this year, or more.

Great start with a new head coach and

completely new system for offense and defense alike. Just goes to show that one

can enjoy instant success using new methods to play with. But… sustained

success is yet another story.

Before the Dolphins can operate their new

playbook systems with unconscious competence (aka in their sleep) each

individual must survive a lot more real-time action in games to come. They have

to work the system in hot, humid weather (done that) and cold weather alike.

Players have to execute in oppressive sunshine, rain, wind and snow. They have

to operate the new system against weaker opponents and much stronger

competition, sometimes with a lead and other times while coming from behind.

When asked how they felt about the upcoming

season, most of our talented veterans replied that they are studying longer &

harder than ever. New playbooks to digest, new assignments on the field to

cover, a whole new way of seeing the game they have played professionally for a

decade of longer.

No Different For You And Me

Veteran free agent NFL players may be stars in the previous system of play

they had mastered. Some are highly talented, but never quite reached their

potential measure of success. When faced with a new coaching change or even a

different team, each player begins anew. Just because they know how to tackle,

run, catch and throw does not mean a new system is picked up on the dead run.

Hours of study, practice, mental errors and game-time mistakes are made along

the way.

If that is actual fact for NFL football players

and play, why is it that experienced traders ask me if they can pick up a new

trading method or system and execute flawlessly in short order? Why do

experienced traders cling to false expectations of themselves and/or a method

without taking time to digest the playbook and learn to play their position in

the market? Why do experienced traders pay good to sometimes obscene amounts of

money for educational material and toss it aside when they discover a few words

on paper or pictures in a video cannot create instant results for them?

I’ll leave those rhetorical questions for you

to answer within. I’ll close with an example of what it takes to succeed on a

professional level. Zach Thomas, one of the best inside linebackers to ever play

football is too small and too slow for his position. He creates Pro-Bowl level

success each year thru time, effort and massive study of his craft. All summer

long this ten-year veteran studied video tape footage of other small linebackers

to pick up a few more tips to hone his skills. In Sunday’s live market action,

his work efforts gleaned from months of study resulted in several game-changing

tackles at crucial price turns in the market.

I mixed my metaphors in the paragraph above on

purpose. Zach Thomas knows the price needed to succeed in any profession is

time, effort, study, patience and investment in oneself. Anything less creates a

tackling dummy for him and mere liquidity in the financial markets for us.

Hope this helps!

Trade To Win

Austin P

(free pivot point calculator, much more inside)

Austin Passamonte is a full-time

professional trader who specializes in E-mini stock index futures, equity

options and commodity markets.

Mr. Passamonte’s trading approach uses proprietary chart patterns found on an

intraday basis. Austin trades privately in the Finger Lakes region of New York.