One Man, One Vote

While over the long-term, the fate of the market does not rest on the

Presidency, there are likely to be short-term effects.

As I stayed up into the wee hours of the morning to see if my man would take

home the prize, I followed the futures market. By watching an overnight chart, I

could easily see who the bulls were cheering on. The last red bar on the left is

what happened when uncertainty returned. Take a look at the

five-minute overnight chart of the futures. Amazing. Personally, I’m voting for a 50-year bull market.

Oracle

(

ORCL |

Quote |

Chart |

News |

PowerRating), mentioned as a short in Trading The Open, continues to

move lower. Remember to trail your stops.

As for other market internals, the SOX is down roughly 3.60% and the Nasdaq

futures were halted when they went down lock-limit. They have reopened already

and have moved even low, but not much.

Today’s Watchlist:Â

(

SEBL |

Quote |

Chart |

News |

PowerRating)

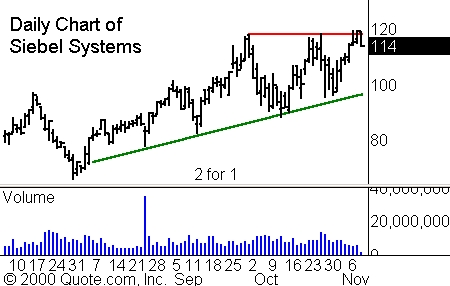

Siebel Systems

(

SEBL |

Quote |

Chart |

News |

PowerRating), in the

software group, has been one of the best stocks in term of patterns. It often

sets up to nicely to help us choose our entry points. Wednesday, it finds itself

in the midst of a new chart formation. It has formed a bit of a high level

W-formation.

With resistance near 120 now tested

several times, it has established a breakout level for us to watch. Set your

alerts near this key level and watch for a breakout. Ideally, any move will be

backed by heavy trading

In the bigger picture, there is also an

established trendline which the stock has bounced off several times over the

course of the last few months. Thus, should the stock be unable to break out from

the near-term formation, we will monitor it for a bounce off the trendline.

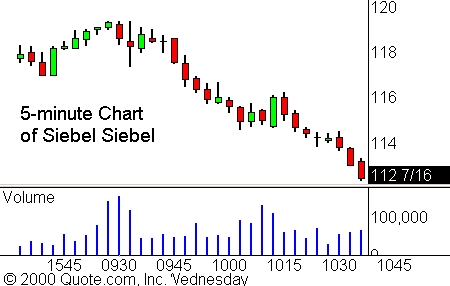

Currently, the intraday chart suggests that we should not expect

a breakout today. Nonetheless, I keep Siebel on my permanent watchlist, as it

often sets up for nice daytrades.

Â

Until later,