Repeat Performance

As usual, we opened up and traded down. That is usually a sign of a bear market,

which it seems we have been in for some time now. Watch for another late-day reversal if the buyers come in. Stocks have been jiggy and market makers are

lifting over and over to try to get you to over-pay. Use caution on stocks whose

intraday patterns you are not familiar with.Â

Personally, I did alright on my one bellwether that I held overnight, and

otherwise, I am watching financials and drugs when techs weaken.

Today’s Tech Watchlist:

(

PDLI |

Quote |

Chart |

News |

PowerRating),

(

QCOM |

Quote |

Chart |

News |

PowerRating)

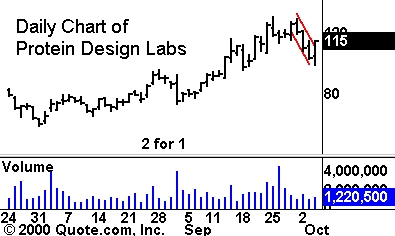

Protein Design Labs

(

PDLI |

Quote |

Chart |

News |

PowerRating)

has been trending quite well for the past few months. Wednesday’s intraday

reversal was a rally out of a pullback, and a 1-2-3-4 setup. Once again, it

depends on the attitude of the broader market and the other biotechs. This

subgroup has been performing rather well of late, but remains volatile. Set your

alerts for a move above Wednesday’s intraday high, and watch for a continuation of

the short-term rally. If we see weakness again, it may be a viable short, should

it continue to extend the downward channel that it started to form.

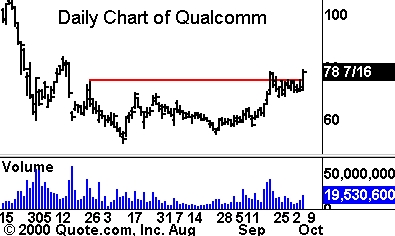

Remember when Qualcomm

(

QCOM |

Quote |

Chart |

News |

PowerRating) was the king of the market?

Remember when it just would not die? While those days are gone (at least for the

moment, I don’t make predictions), it is trying to make a bit of a comeback. The

comeback is in the form of a low-level breakout. QCOM has appreciated more than

25% since its lows of September. The intraday high from Wednesday tapped the

resistance level set in September. Watch for a breakout above this level to

offer a long opportunity. If you take a position, put your stops in, because

this market turns on a dime (and thanks to decimals, sometimes on a penny).

Â

Until later,Â