On The Defensive

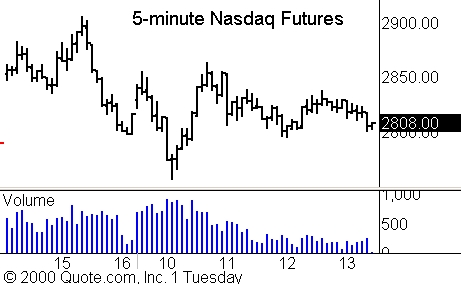

The Nasdaq futures have basically been idle since the big swings this

morning.

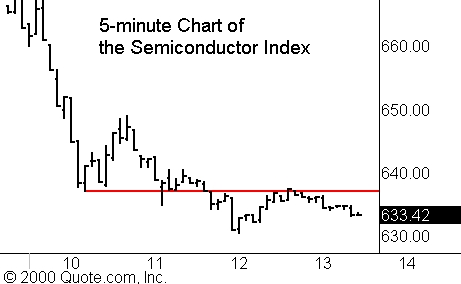

The semiconductors continue to drift lower. Based on this

weakness, the general trend of the day still seems to be negative, although the

Composite and the 100 are slightly green.

The HMOs, which broke out of their near-term channel on Monday,

are making a tiny recovery on Tuesday. Unfortunately for the longs, support has

now become resistance. Defensive names have been strong lately, so if you like

to trade from the long side, keep an eye on the defensive groups. Drug and

defense companies should be on your watchlist.Â

For example, Boeing

(

BA |

Quote |

Chart |

News |

PowerRating) is breaking out from a

cup-with-handle today.

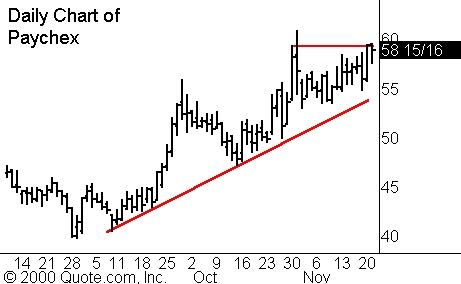

Paychex

(

PAYX |

Quote |

Chart |

News |

PowerRating), mentioned on Monday, tested resistance

yesterday but pulled back this morning. While it was down a bit earlier today,

it is slowly rebounding. Watch this one for a trade on the long side.

Interestingly, it has not been a victim of the recent volatility.

Today’s Watchlist:Â

(

DST |

Quote |

Chart |

News |

PowerRating)

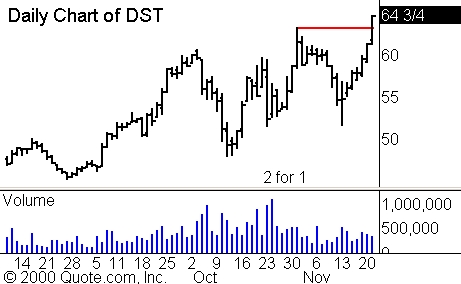

DST Systems

(

DST |

Quote |

Chart |

News |

PowerRating), in the computer services group, is

breaking out of a cup formation after forminng a V-bottom earlier in the month.

It pushed through resistance on Tuesday without hesitation. Currently trading at

its day high, this is one to watch for a continuation move on Wednesday.Â

Set your alerts for a move above Tuesday’s intraday high.

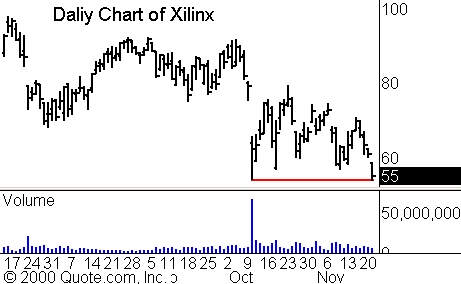

Xilinx

(

XLNX |

Quote |

Chart |

News |

PowerRating), mentioned as a potential short earlier,

continues to trade near its lows. If there is a selloff at the close, it may

push through support.

Until later,