“The” Tech

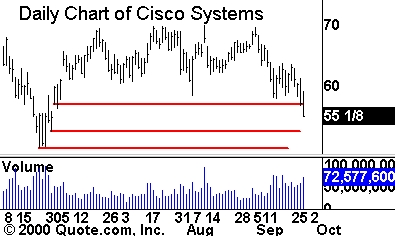

Whenever people talk about the Nasdaq,

they seem to immediately discuss the status of Cisco Systems. CSCO is perhaps

the center of the tech universe. While it has not been a leader for some time, it

still remains a prime bellwether of the longer-term picture of the techs.

Currently, CSCO stands just below a support level. While many see 58 as the key

level to watch, I think that there is a support at several different levels, as

shown on the chart. On the upside, CSCO continues to have resistance at 70.

Thanks to all who who took

my trivia test on Tuesday. The question was simple, “Which stock has the greatest

weighting in the semiconductor index?” While many people think that the answer is

Intel, in fact, in the number one position is — Rambus, followed by Xilinx.

Today’s AM Tech

Watchlist:Â

(

MSFT |

Quote |

Chart |

News |

PowerRating),

(

RATL |

Quote |

Chart |

News |

PowerRating)

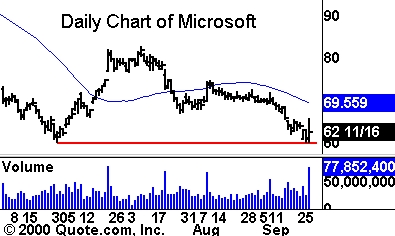

Microsoft

(

MSFT |

Quote |

Chart |

News |

PowerRating) is a

name that we are all familiar with. It rallies a bit on the Supreme Court’s

decision to let the trial follow the traditional order in the appeal process.

The failure to rally over the highs from earlier this month leads me to leave

MSFT on the short list. Testing support for the last three days, MSFT may still

break down. Set your alerts near 60 and Tuesday’s intraday low as we watch for a

breakdown. Look for a short opportunity based on a break of support.

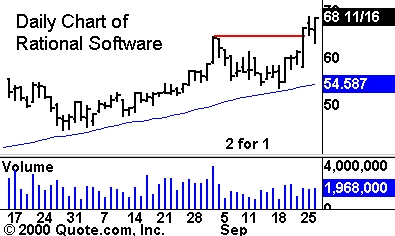

Rational Software

(

RATL |

Quote |

Chart |

News |

PowerRating),

on the long side, rallied back quickly after its intraday move below the

breakout level on Tuesday. On Monday, it gapped open, perhaps killing the

opportunity to trade the continuation. Wednesday may in fact provide another

opportunity to trade the continuation. Set your alerts near Monday and Tuesday’s

intraday highs and watch for another move north. Volume-wise, it has been

trading consistently at just under two million shares, which provide ample

liquidity. If you are a pullback trader, watch for another retracement to the

breakout level highlighted below.

Today’s AM Non-Tech

Watchlist:Â

(

GCI |

Quote |

Chart |

News |

PowerRating)

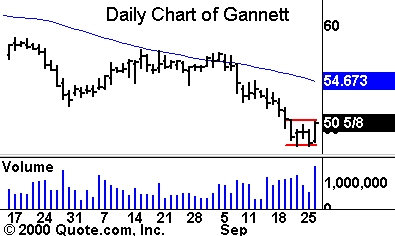

Another setup has come

across my radar, this time not in the tech sector. Gannett

(

GCI |

Quote |

Chart |

News |

PowerRating) has been

consolidation near its lows for the past five days. This may be a pause before

another left lower. As always, we will avoid having a directional bias. Watch

for a move outside of the trading range. Set your alerts near 50 3/4 and 50.

Until later,Â