Phone Homeless

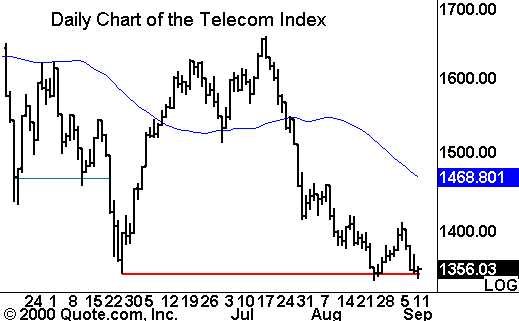

When playing the short side, it’s crucial to know

what the weakest sectors are. Currently, the Telecom Index is trading near a

low. It has formed an inverted cup-with-handle pattern on the daily charts,

which presents a potential short opportunity.

Today’s Watchlist:Â

(

MRVL |

Quote |

Chart |

News |

PowerRating),

(

ENER |

Quote |

Chart |

News |

PowerRating),

(

PALM |

Quote |

Chart |

News |

PowerRating)

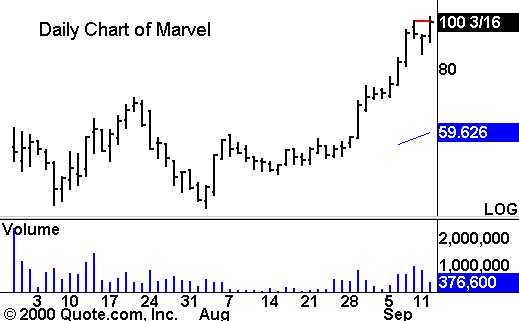

Marvel

(

MRVL |

Quote |

Chart |

News |

PowerRating) is testing its highs once

again after forming a three day micro-cup pattern. If it is strong enough to

close above Friday’s intraday high, watch for a continuation move on Wednesday.

The volume has been picking up in the last few days, suggesting that there is

some investor interest in the stock. The stock is a bit extended since breaking

out the first time in mid-August, so perhaps only more aggressive traders will

want to consider opening positions.

Energy Conversion Devices

(

ENER |

Quote |

Chart |

News |

PowerRating) may be

moving because of Fuel Cell

(

FCEL |

Quote |

Chart |

News |

PowerRating). While Fuel Cell is already very

extended and parabolic, ENER has just broken through its previous high. If the

stock is strong, it will be able to close at a new high.. Should this occur,

watch for another move higher on Wednesday. If it retraces, it may find support

at Monday’s intraday high, which was a resistance level, based on the June

activity. This group, including FCEL and ENER is not for the faint of

heart.Â

Palm

(

PALM |

Quote |

Chart |

News |

PowerRating) is setting up for the

low-level traders out there. Palm has been rallying since bottoming out around

20. Watch for a close above the resistance level highlighted below. This may

offer a long opportunity. Watch for resistance near the peaks near the left side

of the chart, as they might be trouble spots.

Until later,Â