Emini Futures Outlook

Emini Futures Outlook

Austin Passamonte

Weekend Greetings!

Price action in November withered

inside narrowing ranges while VIX levels dropped to decades’ lows. That type of

pall in price action cannot last forever… when one extreme is broken, markets

tend to swing towards opposite side of the fulcrum. The recent return of

volatility is built upon dip buyers eating every market drop like it’s the last

time markets will ever be this “cheap”.

Maybe that’s true, maybe not. Professional

traders do not succumb to the forecasting business: they trade what is seen

instead of what’s (emotionally) felt. Right now we’re seeing market action ala

December 1999, regardless of all else.

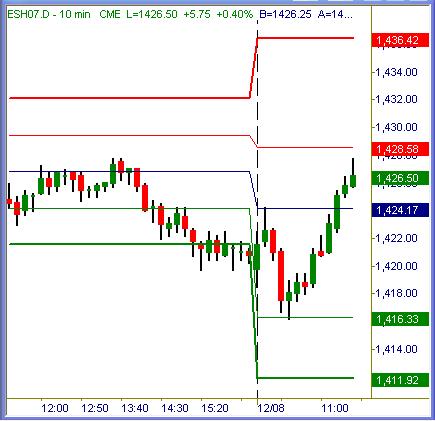

Chart 1: ES (+$50 per index point)

S&P 500 futures waggled both ways in the

premarket, traded up to clustered resistance at daily pivot (navy blue line) and

immediately sold off down to S1 value (light green line). From there the buy

programs kicked in, and dipsters pushed it up to new session highs near R1 value

(light red line) by 11:30am EST.

Plenty of profit potential for intraday swing

traders in both directions, and scalpers would have left too much money on the

table. Recent volatility spike following dead market conditions in November is a

most welcome return to normalcy!

Chart 2: ER

(+$100 per index point)

Russell 2000 futures traced the same technical

path from open thru the swings by midday. A $900 per emini contract move lower

was followed by a $1,100 per emini contract move higher. How hard is it to pull

$500 swings out of one or both? Not very… viva la volatility :>)

Chart 3: ES (+$50 per index point)

S&P 500 futures are projecting price objectives

1440s before next cluster of sell stops are found. These are levels we could see

by next Tuesday, before the post-fed meeting Wednesday where directional

probability is high. First, the 1430 level must be breached on a daily close

basis.

Chart 4: ER

(+$100 per index point)

Russell 2000 futures measure the same general

swing with 817 to 836 as primary objectives, 848 is not out of the question

before year’s end. Onward & upward unless otherwise thwarted.

Summation

Buy-side bias has become blatant. There is no dip that goes lacking for bids

very long. Any intraday dip is either erased before the closing bell or next

day, regardless of volume patterns or anything else. There are just three weeks

left until 2006 is in the books, and closing at/above current levels is most

likely scenario by far. Retail traders will wait until Jan 2nd to place sell

orders and book profits that generate a tax bill in April 2008. Fund managers

are printing their own bonus checks right now… under the circumstances, who

wouldn’t be motivated to resist selling efforts at all cost?

As an intraday trader with equal ability to

make money long or short, I have no bias or preference where price action goes

up or down. I do sincerely hope it goes somewhere, hopefully in trend fashion on

rising volatility. With no inherent need for price action to go one direction, I

don’t try to predict what might happen. Reactionary trading without bias or

expectation works best for intraday players… keeps the mind clear & prepared.

Next big catalyst ahead is the FOMC event

Tuesday. That followed by triple-witch expiry at week’s end leads to the last

couple weeks in December. We are entering a period where volume will wane and

tapes will rise almost assuredly. The next big drop is not likely to come until

January, if then. Sell signals work when given, but downside has been a struggle

more days than not. Be aggressive on the long trades, picky on the short trades

until New Year’s champagne has gone flat. Strong fundamentals now in play trump

what the market would like to do versus what will be forced upon it.

Trade To Win

Austin P

[Online

video clip tutorials…

open access]

Austin Passamonte is a full-time professional trader who specializes in E-mini stock index futures, equity

options and commodity markets. Mr. Passamonte’s trading approach uses proprietary chart patterns found on an

intraday basis. Austin trades privately in the Finger Lakes region of New York.