Forex Trading With The COT Report

Every Tuesday the U.S. Commodity Futures Trading Commission or CFTC publishes the Commitment of Traders Report, a.k.a. COT Report.

This report provides the net number of long/short positions across a variety of commodities including currency futures specifically commercial and non commercial speculative interest. As you know, Forex pairs are not the currency futures, however, the pairs and futures mostly move in sync.

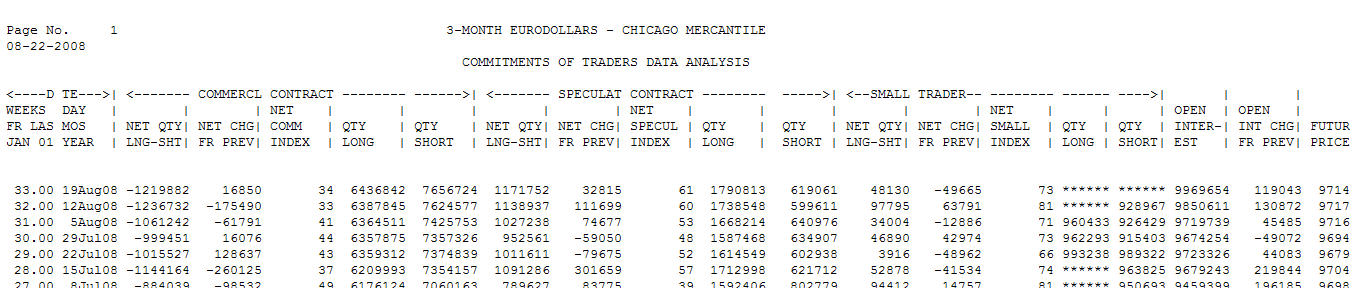

Being aware of the futures provides insight that can’t be obtained from the pairs. The report is created every Friday, but not released until Tuesday of the following week. The COT report is a fantastic tool to measure sentiment of the large players in currency trading, particularly since volume data is not available in Forex. Here is an example of the latest data from the report:

You can find the COT report at this link: https://www.cftc.gov/dea/futures/deacmesf.htm

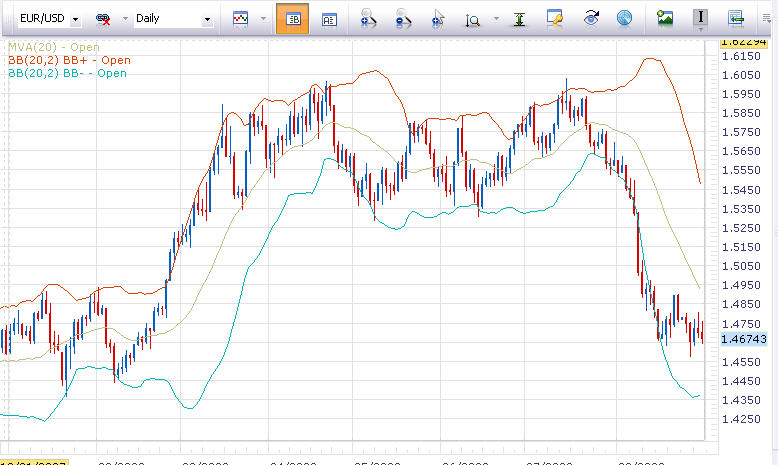

The primary way traders use the COT data is by identifying extreme positions either long or short by non commercial large speculators. Commercial traders have less of an impact on currencies as the majority of commercial hedging is done in the Spot Market not the futures. When readings hit an extreme, either long or short, the theory is the market is near a top or bottom since there is no one left to buy or sell. The U.S. Dollar COT Index was at 100 last week, which is up from 98 the week previous. One hundred is an extreme reading, the highest it has been since 2005 when the USD created a top. This is bullish for the Dollar, however it also indicates that a top may be forming soon.

David Goodboy is Vice President of Marketing for a New York City based multi-strategy fund.