PowerRatings Chartology: TWM, QID, SDS and Inverse ETFs

As the number of stocks trading above their 200-day moving averages grows smaller, one of the areas that has become more and more fruitful for swing traders is the world of exchange-traded funds – particularly inverse exchange-traded funds.

Because of this inverse ETFs afford swing traders with some unique opportunities and flexibilities when it comes trading markets to the downside, allowing swing traders to “buy” when betting against a market rather than selling stocks or ETFs short or trading put options. Inverse ETFs also provide a very cost-effective method of hedging long trades or investment positions.

ProShares UltraShort Russell 2000

(

TWM |

Quote |

Chart |

News |

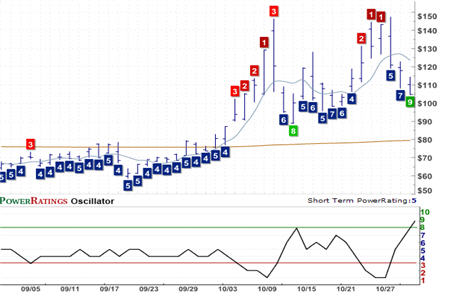

PowerRating) Short Term PowerRating 9. RSI(2): 11.19

Here, we are most interested in being able to trade these ETFs and are fortunate to be able to do so in virtually the same way that we are able to trade stocks. More than that, in many ways, as the PowerRatings charts below reveal, high PowerRating ETFs can be traded using many of the same approaches that swing traders use to trade high PowerRating stocks.

I’ve provided charts of three inverse ETFs of three of the most widely traded markets: the Russell 2000, the Nasdaq 100 and the S&P 500. Not only are all three inverse or short ETFs, but all three are also leveraged 2 to 1.

ProShares UltraShort QQQ

(

QID |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 9. RSI(2): 10.20

Note how all three of these funds made short term peaks on October 10. In the instances of both the QID and the SDS, that October 10 peak was characterized by both ETFs earning Short Term PowerRating downgrades to 1. With TWM, that extreme downgrade actually occurred on October 9, the day before the true peak

Those of you who are familiar with PowerRatings Chartology know that I have often suggested that low Short Term PowerRatings in stocks trading above the 200-day moving average can be used in much the same way as an overbought/oversold indicator, alerting traders to the likelihood of a pullback in the near-term.

ProShares UltraShort S&P 500

(

SDS |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 8. RSI(2): 20.14

The same is true with PowerRatings and exchange-traded funds. Within days of those low Short Term PowerRating extremes, all three inverse ETFs sold off dramatically, so much so that their PowerRatings moved from extreme “consider avoiding” territory well into “consider buying” territory. This was especially the case in both the TWM and the SDS. And as we have seen in the past, those pullbacks into the “consider buying” territory of higher Short Term PowerRatings resulted in relatively powerful rallies mere days later.

Again, the point I want to leave with swing traders is that our strategies for stocks are not only excellent ways for traders to stay ahead of the game during this bear market. When applied to exchange-traded funds, especially inverse or short exchange-traded funds, these same strategies with our Short Term PowerRatings can help make the difference between struggling and succeeding as a trader during these difficult times.

Does your stock trading need a tune-up? Our highest Short Term PowerRatings stocks have outperformed the average stock by a margin of nearly 17 to 1 after five days.