High PowerRating, Low Price: 3 Stocks for Swing Traders

Stocks are following through on yesterday’s massive, post-election sell-off. The Dow industrials are down more than 300 points as of noon Eastern.

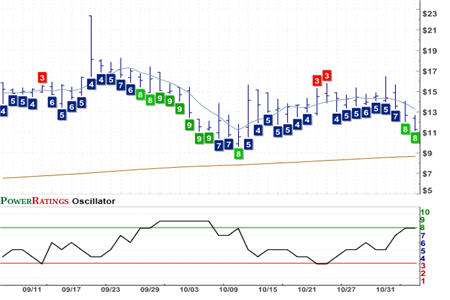

From oversold to overbought and back again… this is the rhythm that our testing has uncovered. Whether stocks are trending or moving sideways, there is a pattern – almost like breathing – in which stocks oscillate from one extreme to the other.

When the extremes are relatively modest, the opportunities for profit still remain, but they tend to be smaller. However when those extremes become great – fueled by increased volatility and uncertainty, the opportunities for swing traders to take advantage of markets that have too many buyers or too many sellers at any one point in time can be similarly great.

CSG Systems International

(

CSGS |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 8. RSI(2): 6.68

Given the aggressiveness of the selling we are seeing midway through trading on Thursday, it looks like we are ending our journey into the overbought and resuming our excursion into the oversold. In two days, for example, the S&P 500 has gone from a 2-period RSI of more than 90, to a 2-period RSI that, as I write, is less than 20. In the Nasdaq, the swing from one extreme to the other has been even more dramatic.

Crawford & Company Class B

(

CRD.B |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 8. RSI(2): 1.91

Our testing tells us that such extreme movements in the markets almost always create new opportunity for swing traders. Often these opportunities mean that swing traders will be buying when the world is fearful, and selling when people believe that nothing can go wrong. Without trying to be “contrarian” in some ideological sense, good swing trading often is just that: taking advantage of the mob mentality that tends to be wrong at market turns.

Ultratech Inc.

(

UTEK |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 7. RSI(2): 20.02

Given the pullback we are seeing today, there are a few stocks that were trading above their 200-day moving averages as the markets opened this morning. I have provided their PowerRatings charts here. These are some of the stocks that swing traders may want to keep an eye on and, insofar as they remain above their 200-day moving averages, put on watch lists as potential opportunities when they become sufficiently oversold to become potential targets for trades to the upside.

Does your stock trading need a tune-up? Our highest Short Term PowerRatings stocks have outperformed the average stock by a margin of nearly 17 to 1 after five days.

| Click here to start your free, 7-day trial to our Short Term PowerRatings! |

Whether you have a trading strategy of your own that could use a boost or are looking for a way to tell the stocks that will move higher in the short term from the stocks that are more likely to disappoint, our Short Term PowerRatings are based on more than a decade of quantified, backtested simulated stock trades involving millions of stocks between 1995 and 2007. Click the link above or call us at 888-484-8220, extension 1, and start your free trial today.

David Penn is Editor in Chief at TradingMarkets.com.