Nasdaq Trading Strategies: QQQQ, PSQ, QID

Stocks are taking a breather in the first hour of trading on Tuesday, with the Dow off more than 1% and the other major indexes also pulling back mildly.

The rally in stocks over the past few days has helped change the landscape for short term stock and ETF traders. Whereas we were dealing with a relatively neutral market a few days ago, we are now looking at a market that is again increasingly overbought.

And while this has many traders beginning to think about the money that will be made if stocks continue to advance, we are focused more on the way that we have been making money for years — particularly through this downturn over the past several months: selling strength and buying weakness.

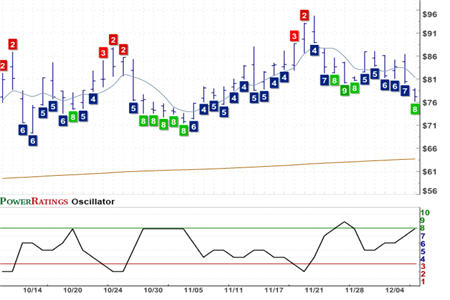

PowerShares QQQ Trust ETF, QQQQ

(

QQQQ |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 3. RSI(2): 87.16

So what kind of strength are we looking to sell and what kind of weakness are we looking to buy?

Our Short Term PowerRatings are a helpful guide in both instances. As stocks become overbought, we begin looking for those stocks with low Short Term PowerRatings as potential targets for short sales. This goes for ETFs, as well, which often can be more efficient and effective to short than individual stocks.

ProShares Short QQQ ETF, PSQ

(

PSQ |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 8. RSI(2): 11.43

At the same time, as stocks become more overbought, short and inverse ETFs become more and more oversold. We treat short and inverse ETFs the same way we treat regular ETFs and stocks: when their Short Term PowerRatings rise, moving into the 8, 9 or 10 area, we become alert to the potential that these high Short Term PowerRating stocks and ETF to outperform the average stock or ETF over the next few days.

Focusing on the Nasdaq Composite, which remains mildly overbought as of this writing, there are a number of securities that traders should be paying attention to. These include the PowerShares QQQ Trust ETF, QQQQ, which tracks the Nasdaq 100, the ProShares Short QQQ ETF, PSQ, which tracks the inverse of the Nasdaq 100, moving up as the Nasdaq 100 moves down, and the ProShares UltraShort QQQ ETF, QID.

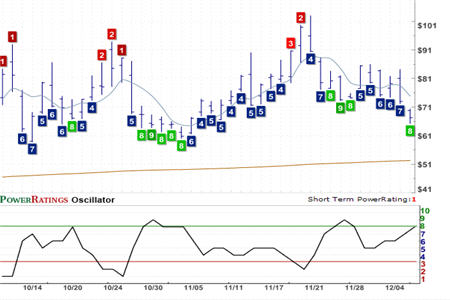

ProShares UltraShort QQQ ETF, QID

(

QID |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 8. RSI(2): 12.08

Like the ProShares Short QQQ ETF, the UltraShort version also tracks the inverse of the Nasdaq 100. The key difference, however, is that the UltraShort QID is also leveraged 2 to 1, magnifying gains — but potentially magnifying losses — as well. Traders and investors should keep this in mind when trading leveraged ETFs.

According to a recent report, eight out of ten securities traded are exchange-traded funds. Want to learn how to trade them? Click

here to find out what traders are saying about Larry Connors’ new book, Short Term Trading Strategies That Work: A Quantified Guide to Trading Stocks and ETFs!

David Penn is Editor in Chief at TradingMarkets.com.