Battle Plan Trade of the Week: QQQQ, XLP and Exits on the Open

An hour after the opening bell on Monday and stocks have already retraced 1/3 of Tuesday’s Fed-induced rally.

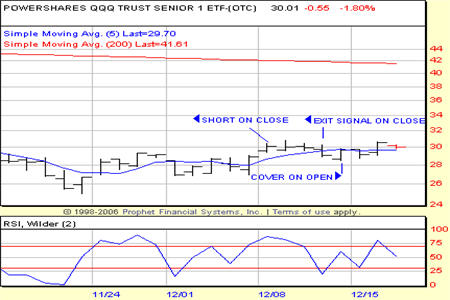

As the markets became more and more overbought last week, we began adding short positions in a number of ETFs with 2-period RSIs that had entered extreme territory.

By the way, if you’d like to learn how to trade using the 2-period RSI, click here.

This week in the TradingMarkets Battle Plan for Stocks — our pre-market subscription trading service for stock, option and ETF trading — two trades in particular stand out. Both of these trades were short trades in exchange-traded funds: the PowerShares QQQ Trust ETF, QQQQ

(

QQQQ |

Quote |

Chart |

News |

PowerRating) and the Consumer Staples Select Sector SPDRS ETF, XLP

(

XLP |

Quote |

Chart |

News |

PowerRating).

What I want to point out about these two trades — both of which were exited profitably late last week — is twofold: one, the crucial role the 2-period RSI played in helping alert us to these opportunities and two, how exiting on the open following an exit signal can actually work out in the favor of the trader.

First, the 2-period RSI. There may not be a hotter indicator right now than the 2-period RSI, which Larry Connors and his research team have been working on since 2004. We use the 2-period RSI as a primary tool to separate overbought and oversold markets from neutral ones.

Although the parameters sometimes vary depending on the strategy, we know that when an ETF’s 2-period RSI starts to climb above the 70 level — the traditional “overbought” zone with the Relative Strength Index — and that ETF is trading below its 200-day moving average, then there is a strong chance that the ETF will underperform in the near-term.

On December 8, both QQQQ and XLP fell into this category, with 2-period RSIs of more than 87 in the QQQQ and more than 81 in the XLP. We alerted our subscribers to these two opportunities, suggesting exits when the 2-period RSI moved from its overbought level north of 70 back to an oversold level south of 30.

Those oversold levels were reached on the same day, December 11, with QQQQ’s 2-period RSI falling to below 21 and XLP’s 2-period RSI sliding to less than 15 on the close.

As sellers of strength (i.e., overbought markets) and buyers of weakness (i.e., oversold markets), this move in the 2-period RSI told us that it was time to cover short positions in both ETFs.

Here is the second interesting point about these trades. We get our signals at the close, generally speaking, and subscribers can certainly exit trades on the close. But our research indicates that traders can often wait until the following open to exit trades. Moreover, sometimes, this additional overnight exposure can truly work in the trader’s favor.

For example, the QQQQ was priced at 29.09 when we got our exit signal. But traders who waited until the following open we able to cover their short at 28.69. Similarly, the exit signal in XLP came as the ETF closed at 23.11. The opening price for traders who covered the following morning? 22.70.

If your trading has gotten tougher over the past weeks and months, then consider a free trial to our TradingMarkets Battle Plan for Stocks. Every day we’ll provide you with incisive, before-the-bell commentary and analysis on the day’s markets to help put your trading in context. We’ll give you suggested entries and exits for trade opportunities that may be only hours away. And we’ll give you what many other people can’t: model-driven percentages so that you know the historical win rate going back to 1995 for every single trade idea – long and short.

Give the TradingMarkets Battle Plan a read before the next market open. Click here to start your subscription or call us today at 888-484-8220. Come see what the TradingMarkets approach to trading can do for you.

David Penn is Editor in Chief at TradingMarkets.com.