TradingMarkets Danger Zone: 3 Stocks for Traders to Avoid

Stocks are off to a negative start on what is likely to be a light volume trading week.

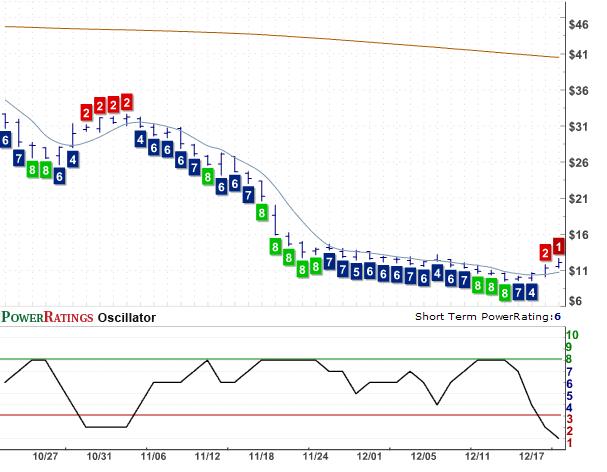

There are two situations in which a trader will confront a stock with a Short Term PowerRating of 1.

Stocks with Short Term PowerRatings of 1 are stocks that have been downgraded to our lowest level of “consider avoiding” stocks. These are the stocks which have typically moved too far too fast to the upside, either gapping up by large amounts, or closing higher for session after session without pullback, often climbing so quickly that their 2-period RSI values soar into the overbought stratosphere.

Learn how to trade pullbacks in fast-moving stocks using the 2-period RSI! Click here!

These are also stocks that have tended to underperform the average stock in the short term. Our research into short term stock price behavior, for example, revealed that stocks with Short Term PowerRatings of 1 have lagged the average stock by a margin of nearly 5 to 1 after five days.

This makes stocks with Short Term PowerRatings stocks to avoid — or to sell short.

Arbitron Inc.

(

ARB |

Quote |

Chart |

News |

PowerRating) Short Term PowerRatings 1. RSI(2): 94.59

When we find stocks with Short Term PowerRatings of 1 that are trading above their 200-day moving average, these one ratings often help traders not just exit or avoid these stocks. 1-ratings in stocks above the 200-day moving average can help alert traders to potential pullbacks that might be right around the corner. I have shown in my Friday column, PowerRatings Chartology, how traders can use our Short Term PowerRatings in this fashion.

Chipotle Mexican Grill Inc.

(

CMG.B |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 1. RSI(2): 98.05

But when traders spot stocks with Short Term PowerRatings of 1 trading below the 200-day moving average, steering clear – again, or selling short – remains the best option. Because these stocks are already below the 200-day moving average, any “pullback” we see in these stocks is likely to really be the resumption of a downtrend. Their weakness revealed by trading below the 200-day moving average, these 1-rated stocks are the perfect example of stocks experiencing temporary strength in an overall context of weakness. This is the ideal environment for a stock that is likely to disappoint and underperform in the near term.

Oxford Industries Inc.

(

OXM |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 1. RSI(2): 99.08

David Penn is Editor in Chief at TradingMarkets.com.