The Put/Call Edge Plus 3 PowerRatings Stocks

Where ever traders and investors gather there is always talk about the put/call ratio. Literally 100’s of articles and even several books have been dedicated to how to use this ratio to gain a trading edge.

Is there any truth to there being an investment edge by following this ratio? We decided to put this idea to the test and the results were downright surprising.

First, let’s define what is meant by the put/call ratio. It is the total number of puts divided by the total number of calls for all equity and index options traded on the Chicago Board of Options Exchange or CBOE. Most investors use it as a contrary indicator meaning that a high reading means a market reversal is near. On the other hand, low readings mean that the market is confident. High readings are the result of more put buying than call buying. Low readings are caused by more call buying and less put buying.

Testing this theory, we looked 2077 days of end-of-day market data. High readings were those that fell in the top 5 and 10% of all readings. Low readings were defined as those coming up in the bottom 5 and 10%. A median reading was 0.68. It was discovered, via the testing, that high ratios outperformed low put/call ratios. This is completely the opposite of the way most investors and traders think.

A high level of fear in the market has resulted in greater gains than a high level of confidence. Of course this is as measured by the Put/Call Ratio. The opposite also proved to be true in the testing. Short term lows on the ratio are followed by under-performance.

These findings fit perfectly with our basic premise of buying fear and selling greed.

Here are 3 PowerRatings stocks for your short term consideration:

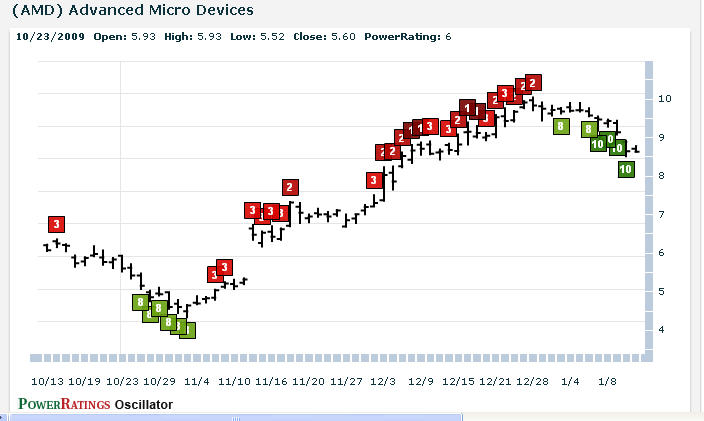

^AMD^

^COGO^

^PRX^

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.