The Government vs the Market & 3 PowerRatings Stocks

An epic battle is underway. The forces of the free market are being more and more affected by both positive and negative government meddling.

There is no question that government intervention prevented a tremendous stock market crash over the last year. The massive injections of liquidity saved many companies outright. Regardless of whether or not a company was a direct participant in the Federal aid, the resulting optimism and cost cutting to push earnings higher led to an over 60% retrace of the 2008 debacle to date. Not even two years later, stocks are on more solid ground primed for additional gains.

However, despite the success of the Government’s programs, the Fed are now making moves that may counteract all the positives created. They are attempting to place a tax on banks, even those who have repaid the funds in full or did not obtain a penny in help. This large bank tax would apply to the highest capitalized 50 banks and would be a 10 year, 15 basis point levy.

While the spirit of this tax may make sense, it’s a clear signal that the government is looking to extradite itself from the economy. In other words, it’s the start of payback time from business. The results of this switch remain to be seen. Is it too early? Will there be waves of more fees, taxation and negative interference as the Feds struggle to recoup their funds? Will regulations go into high gear as a populist driven attempt to punish Wall Street for perceived sins obtains government support? Only time will tell how the economy will react during this change over from Federal assistance to the Reverse.

Fortunately, short term investors don’t need to be focused on the macro economic issues. They need proven tools to locate companies most likely to grow in value despite the underlying economic conditions.

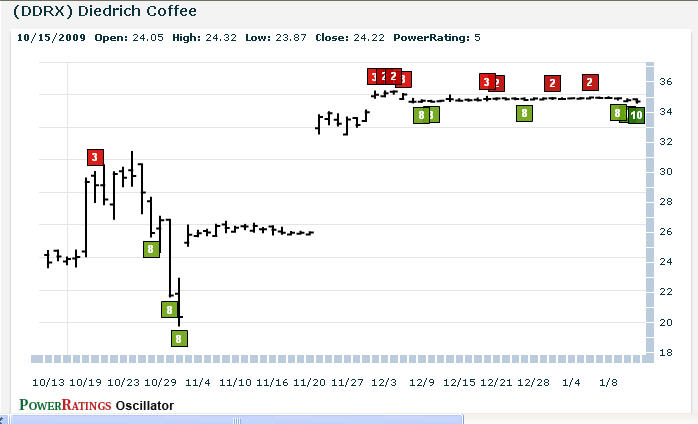

Our Stock PowerRatings are one such proven stock picking tool. They are built upon the study of 8.5 million daily trades from 1995 to 2006. It is a ranking system of 1 through 10 with 1 representing the worse performers and 10 being the best performers. The system gauges stocks probability of outperforming against the S&P 500 over a 5-day period. Statistics clearly show that 1 rated stocks perform 5 times worse than the S&P 500, while 10 rated stocks outperformed 14.7 times the S&P 500 during the next 5 trading days.

As you know, past performance is no guarantee for future success, but our PowerRatings have proven time and time again to locate stocks primed for short term gains.

Here are 3 highly ranked PowerRatings stocks for your consideration:

^DTSI^

^FBR^

^DDRX^

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.