Traders Turn to Face the Changes & 5 PowerRatings Stocks

“Ch-ch-ch-ch Changes, Turn and face the strain, Ch-ch-Changes, Oh look out you, rock ‘n rollers.” These famous lyrics from David Bowie’s song “Changes” are an ideal metaphor of what could be happening at the Federal Reserve meeting today and Wednesday. Substituting the term “rock ‘n rollers” with “traders” would be apropos for the possible changes taking place right now.

In fact, Federal Reserve policy makers are considering adopting a new benchmark interest rate to replace the one they’ve relied upon for the last 20 years. This will not be known until the Fed statement at about 2:15 p.m. on Wednesday; however, odds are this big change is going to occur.

As you know, the federal funds rate has been used for the last 2 decades. However, with the recent financial meltdown the fed fund rate has been impossible to control. A trillion dollars has been injected into the economy to shore up a failing economic infrastructure. This deluge of cash has altered the financial landscape to such a degree that a new benchmark rate is needed. Interest rates are the primary method the Fed uses to control inflation so the choice of a benchmark is of utmost importance. Talk is that the new benchmark will be the interest rate on the Banks excess reserve. This “excess reserve” is presently $1 trillion dollars and was fashioned by emergency loans and a purchase program of treasury debt and mortgage backed securities. If this occurs it is a dramatic change to the underlying economic control mechanisms. However, most economists still believe, the Fed will keep rates unchanged to at least November, 2010.

While this likely change may have long term effects on the economy and stock market; fortunately short term stock investors/traders don’t need to worry very much about the effects on individual equities. However, caution is advised for buying or selling around the announcement on Wednesday.

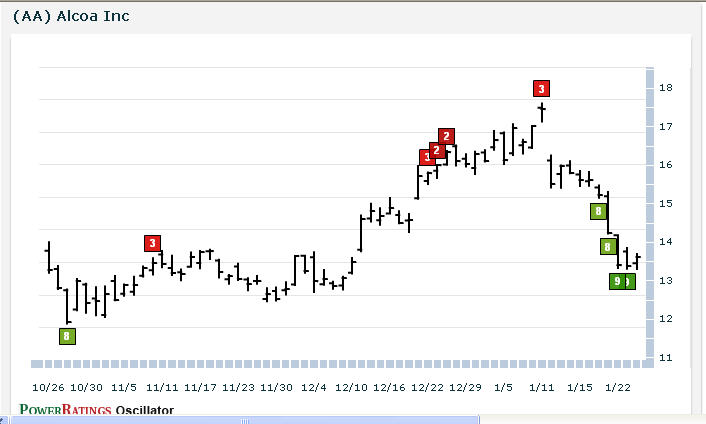

Your job is to locate shares most likely to appreciate over the next 1 to 5 days, sell at a profit, and then repeat. We have developed an easy to use, proven system for locating these companies primed for short term gains called PowerRatings. They are built upon the study of 8.5 million daily trades from 1995 to 2006. It is a ranking system of 1 through 10 with 1 representing the worse performers and 10 being the best performers. The system gauges stocks probability of outperforming against the S&P 500 over a 5 day period. Statistics clearly show that 1 rated stocks perform 5 times worse than the S&P 500, while 10 rated stocks outperformed 14.7 times the S&P 500 during the next 5 trading days.

As you know, a stock’s past performance is no guarantee for its future success, but our PowerRatings have proven time and time again to locate stocks primed for short term gains.

Here are 5 top PowerRatings Stocks for your consideration:

^AA^

^CLW^

^WPRT^

^TBI^

^DTG^

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.