Bulls Buying Weakness & 3 PowerRatings Stocks

One of the overriding themes of the stock market is that weakness gets bought and strength gets sold. Wait a minute, I can hear some of you saying, isn’t that a paradox?

The fact that the market is climbing says it is being bought, right? Of course that is correct, however, the issue is after the market has moved, it is often too late to get on board for the ride higher. One needs to anticipate when the buyers will start to buy, not simply observe that they have bought. Therefore having a quantified and tested system to locate companies that are experiencing weakness that is highly attractive to bargain hunters and professional investors is the key to success. Not only is this fact proven day in and day out in the market, we have extensive studies to prove it makes sense.

We tested the concept of buying strength vs. buying weakness on over 7 million trades since 1995. What was discovered is that there is no edge in buying strength. The odds are no greater of an advance occurring than price simply dropping back after a series of gains. Therefore the buying strength mantra of most short term traders has no better odds of succeeding than a simple random guess. What was discovered via the research was that after 5, 6 and 7-day price drops, the odds of the company out performing the benchmark one week later increased to a statistically relevant level.

In plain English, this means that your odds of success are much improved buying stocks after a 5, 6, or 7 day drop than after a gain for the short term. We have further tweaked this idea into a simple, easy to use 3 step process for picking stocks most likely for gains over the next week timeframe. This article will explain this simple process and provide 3 companies fitting each of the steps for your consideration.

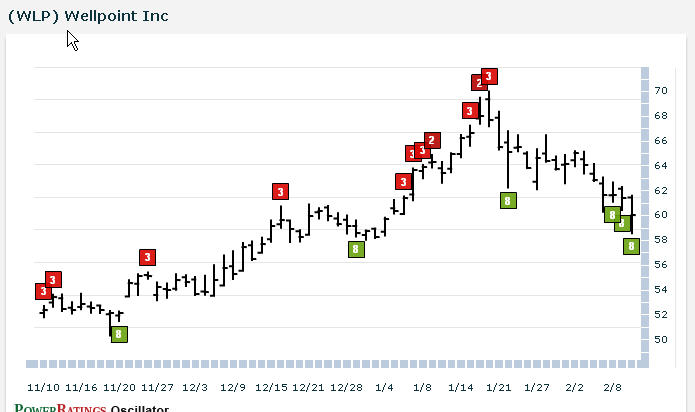

The first and most critical step is to only look at stocks trading above their 200-day Simple Moving Average. This assures that a strong, long term up trend is in place, increasing the odds that you are not buying into a falling knife or catching a stock in a death spiral.

The second step is to drill deeper into the list locating stocks that have fallen 5 or more days in a row or experienced 5 plus consecutive lower lows. Yes, you heard me right, fallen 5 or more days in a row. I know this is counter-intuitive of conventional wisdom of buying stocks as they climb higher. However, our studies have clearly proven that stocks are more likely to increase in value after a period of down days than after a period of up days.

The third and final step is a combination of whittling the list down even further by looking for names whose 2-period RSI (RSI(2)) is less than 2 (for additional information on this proven indicator click here) and the Stock PowerRating is 8 or higher.

The Stock PowerRatings are a statistically based tool that is built upon 14 years of studies into the inner nature of stock prices. It ranks stocks on a scale of 1 to 10 with one being the most volatile and least likely for short term gains and 10 proven to be the most probable for gains over the next 5 days. In fact, 10 rated stocks have shown to have a 14.7 to 1 margin of outperforming the average stock in the short term.

The stocks that fulfill each of the above steps have proven in extensive, statistically valid studies to possess solid odds of increasing in value over the 1 day, 2 day and 1 week time frame.

Here are 3 names ready for short term gains:

^WLP^

^WPRT^

^CACC^

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.