Riding the Chinese Bear & 3 Shortable PowerRatings Stocks

The U.S. economy is tightly intertwined with the international economy. This interconnection affects stocks almost to the degree of domestic events. In recent days, this correlation could be witnessed as Greece struggled with its finances knocking down the U.S. stock market. Soon afterward the European Union made overtures that it was stepping in to save Greece, triggering U.S. stocks to climb sharply higher on the news.

Greece is a very small economy relatively. Imagine the results when a large economy begins to falter or manipulate controls over its growth that are viewed as harmful by its trade partners? China is the fastest growing economy on earth. They just moved to raise their bank reserve requirements in an effort to slow growth and stem inflation.

The reserves were only raised 0.50% however, the Central Bank made it clear that the ratio will keep climbing until the middle of the year. The Chinese Central Bank seems to be on a campaign to deliver a knock out punch to inflation without concern about the wide ranging effects. Stock’s sharp sell off Friday morning is a direct result of the Chinese’s economic moves. Despite things improving in the USA, the international situation holds strong control over the U.S. markets.

Fortunately short term stock traders don’t need to be too concerned about how China or any other macro event affects the market. Your task is to locate individual shares primed to make a quick move in your desired direction regardless of outside factors. While knowing the general recent macro direction of the entire market can be beneficial it isn’t a requirement for you to be an economist to make successful short term trades in either direction. Today, we are going to look at a simple 3 step system for locating shares ready to make bearish short term moves.

The first and most critical step is to only look at stocks trading below their 200-day Simple Moving Average. This assures that the stock isn’t in a long term uptrend that may likely continue.

The second step is to drill deeper into the list locating stocks that have climbed 5 or more days in a row, experienced 5 plus consecutive higher highs, or are up 10% or more. Yes, you heard me right, stocks that are climbing. I know this fly in the face of conventional wisdom of selling stocks as they fall further. However, our studies have clearly proven that stocks are more likely to fall in value after a period of up days than after a period of down days.

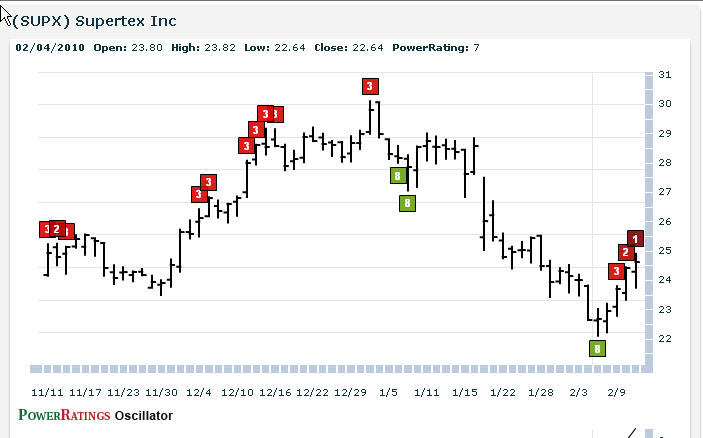

The third and final step is a combination of whittling the list down even further by looking for names whose 2-period RSI (RSI(2)) is greater than 97 (for additional information on this proven indicator click here) and the Stock PowerRating is 3 or lower.

The Stock PowerRatings are a statistically based tool that is built upon 14 years of studies into the inner nature of stock prices. It ranks stocks on a scale of 1 to 10 with one being the most volatile and most likely for short term drops and 10 proven to be the most probable for gains over the next 5 days.

The stocks that fulfill each of the above steps have proven in extensive, statistically valid studies to possess solid odds of dropping in value over the 1 day, 2 day and 1 week time frame.

Here are 3 names ready to drop in the short term:

^PMTI^

^SUPX^

^OCN^

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.