Springing Deeper Into Jobs & 3 PowerRatings Stocks

Being awaken at 2 am by loud bird chirping is annoying. However, it’s a sure sign that spring has sprung irrespective of the actual calendar start date of the season.

A glance outside reveals tiny flowers budding and leaves opening combined with the spring dance of birds and wildlife. It’s the first day it is projected to be over 70 degrees in the North East and the world is alive. The stock market and economy is also vigorously alive.

Most economic indicators are looking up, sans the recent job report and the growing deficit. The deficit is a difficult situation anyway you look it at. However, the job situation isn’t near as bad as it appeared yesterday with the release of the ADP figures.

The reality is that over optimistic economists are inflating their projections making it appear that the number dramatically missed estimates. The labor market is trending higher. Even yesterday’s 23,000 decline was the smallest in 2 years.

In addition, the number was revamped for the prior month to 24,000. It is critical to note that the ADP figure does not include government hiring which is becoming more and more of a factor in the economic picture.

Interestingly, the real payroll figures, from the Fed, will be released tomorrow to a holiday closed stock market. It is expected to indicate that the jobless rate held at 9.7% for the third straight month. The high was 10.1% hit in October, a 26 year peak. It’s a slow grind to improvement but the change has begun.

As the underlying economic factors continue to gain traction, the employment situation will ramp higher. Rapid gains in employment may still be ways off, but the platform is being reconstructed to allow for them. The rising employment will in turn lift the stock market to all time highs. When this will occur is anyone’s guess, but if history is any guide, it’s guaranteed to happen.

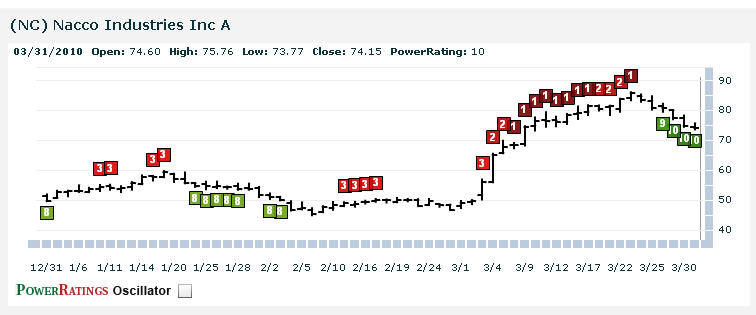

Our stock PowerRatings are one way you can make sure your portfolio is on the right side of this burgeoning bull move. They are a statistically based tool that is built upon 14 years of studies into the inner nature of stock prices. It ranks stocks on a scale of 1 to 10 with one being the most volatile and most likely for short term drops and 10 proven to be the most probable for gains over the next 5 days.

Here are 3 very bullish PowerRatings stocks:

^NC^

^CHRS^

^SPRD^

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.