2009’s Lessons & 3 PowerRatings Stocks

Learning to “expect the unexpected” was the primary lesson investors mastered in 2009. After a brutal 2008 with the S&P 500 falling over 35%, most investors expected more carnage in 2009. However, quite the opposite occurred with stocks rebounded over 20% on average this year.

2009 didn’t start out on bullish footing to say the least. In fact, quite the opposite occurred. The premise of January being the barometer of the market’s year went out the window into the trash heap of Wall Street falsehoods. The month was the worst January on record for stocks. February followed the bearish tenor to another sharply down month in 2009.

The doom and gloomers crawled from the woodwork with proclamation of impending hell on earth for the economy and U.S. citizens. Things kept getting worse despite Congressional approval of a massive economic stimulus package. Stocks continued their unabated slide into March with some shorts posting their best quarter on record. The bottom was finally hit on March 9th, wherein soon after, Ben Bernanke announced the injection of more money to support the economy.

This was the turning point resulting in the next 7 month stock market rally. Most long term bears and volatility traders, without flexibility, got crushed during this time. While losing traders in 2008 began to post serious gains on the year.

Despite the ongoing unemployment situation and credit market difficulties, 2009 will go down in history as a very positive year for the stock market. Whether or not the good fortune lasts is wholly dependent on how the government is able to extract itself from the stimulus to private industry.

Has the stimulus injection done its job for the long term by kick starting the real economy into a money maker? Will the government need to stay involved in supporting private enterprise taking the United States closer to a socialistic rather than capitalistic ideal? Only time will answer these questions. One thing is for certain, expect the unexpected in 2010.

Here are 3 PowerRatings Stocks for your short term bullish consideration:

^KERX^

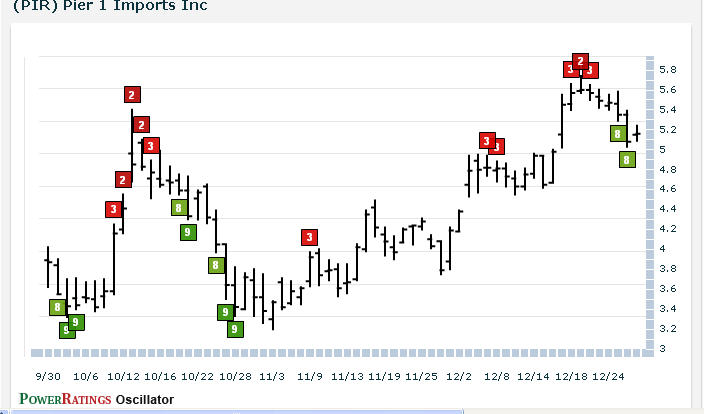

^PIR^

^KNDI^

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.