2010 Through My Eyes & 3 Short Term PowerRatings Stocks

I know it’s said that prediction isn’t something an investor/trader should practice. However on this final day of 2009, it seems apropos to take a look at some of the challenges and successes possible in the New Year.

While it certainly appears like the economy has turned the corner, there are extreme challenges awaiting the United States in 2010. Most of the major indicators have signaled steady improvement over the last several quarters. Earnings have for the most part, been surprisingly solid in the backbone firms of society. Stocks have reflected this improvement by soaring higher bolstered by growing investor confidence and risk taking desire.

Things seem healthy on the outside but digging deeper reveals the improvement may be grounded on a shaky foundation. For example, if one looks closely at the earnings picture it becomes clear that they were shored up by cost cutting measures and not increased production in many cases. This painting of the books so to speak, while not illegal, is only a temporary fix. It acts as a shot in the arm to make things look good over the short term. In essence the firm is buying time to ramp up the real engine of growth, production.

The economic improvement has been primarily driven by massive governmental intervention. The trick in 2010 is for the government to extract itself from private industry without creating too many negative waves. More effort needs to be placed in kick starting the consumer credit markets in unique and innovative ways for bottom up growth. This way, the consumer will once again power the economy. If it’s done correctly, it will be a sustainable, natural support. Therefore the government can get back to governing and not being the sole source of economic strength.

The spectre of interest rate increases also hangs heavy over the stock market for 2010. A very weak Greenback and the situation in the bond market may force the Fed to increase rates. If this occurs, expect a fast and potentially severe drop in the stock market. However, the incremental general nature of rate increases should mitigate the potential of a knock out blow for the year.

A very real possibility exists of geo-political events shaking investors’ confidence this year. New conflicts or random terrorist type attacks hang heavy as tensions have not abated worldwide.

On the other hand, the increased optimism and momentum developed in 2009 can easily carry over into the New Year. Only time will tell for certain how the future will play out. See you next year and expect the unexpected!

Here are 3 stocks for your short term consideration:

^AUXL^

^PAG^

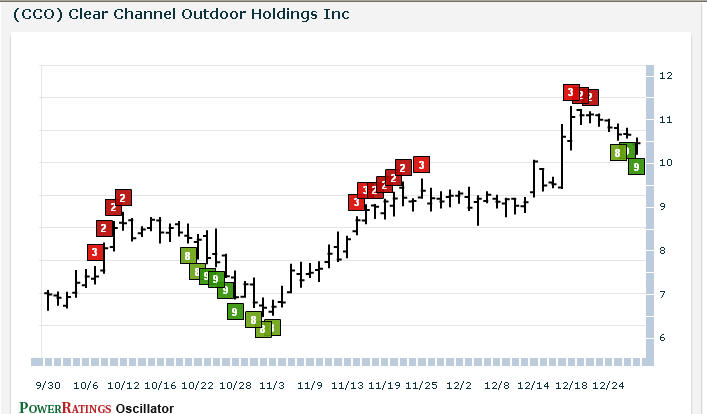

^CCO^

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.