2 Ways to Trade a Pullback

One of the great things about trading is that there are as many ways to make money as there are stars in the sky. Really, it’s true, which is why I get a kick out of hearing some trader tell another trader “that method does not make money” or ” the only way to make money is _____.”

Click here to order your copy of The VXX Trend Following Strategy today and be one of the very first traders to utilize these unique strategies. This guidebook will make you a better, more powerful trader.

Obviously it’s not true that there are too many ways to make money. What works for me, may not work for you and it may be the ideal trading method for someone else. This, to me, is one of the best things about trading for a living. I love learning from other traders what works for them. I also love showing traders simple methods that work for me (see information below on the trading webinar I will be offering in a few days).

I believe that simple straightforward trading systems are more likely to work for more traders than complex trading systems. The reason why is simple – as traders we take our biases with us into the markets. No matter how hard we try to be objective, it will always be the case that our personality influences how we view the markets, just as our unique traits will effect how we view other people.

The very complex trading systems include many moving parts (indicators) which are open to interpretation because the moving parts can present many different scenarios. In the same way that rolling five die will offer more possibilities than rolling two die, a trading method with two components will be easier to interpret and learn than a trading method with five indicators. The simple, robust trading systems are likely to last longer in the markets, are less likely to break down over time and they are also likely to “make sense” for a wide variety of traders.

This is why I enjoy using simple trading systems. Simple trading systems work. Simple trading systems are more likely to stand the test of time. This is why an esoteric correlation between the Super Bowl winner, the lunar phase, the 200-day simple moving average and the S&P 500 is probably not going to stand up to the test of time. However, trading methods that employ simple definitions of trends, support and resistance and simple methods of locking in profits are much more likely to work over decades.

When I work with traders, I am cognizant of the fact that different people bring different biases to the market. For example, you may be biased toward trend following systems, or those sorts of trading systems that allow you to capture a large chunk of the market movement. However, more impatient traders may be biased toward reversal systems, the very antithesis of trend following. This is why it is important to take into consideration your trading personality, if you are trying to employ a trading strategy that does not fit with your trading personality, then you are unlikely to be able to trade the method consistently, and you are unlikely to consistently profit.

This is why it is important to trade methods that make sense to you. Listening to some guru explaining the “right” way to trade is not unlike listening to a guitar player teach the “right” way to play guitar. At the risk of getting too personal, I am genuinely quite happy that Jimi Hendrix learned to play the guitar “incorrectly,” can you imagine if he had learned the “right” way to play guitar?

Working with traders, I have learned that most traders tend to be oriented toward reversal strategies. This means that trend following strategies – which are the opposite of reversal strategies – are not the type of strategies that most traders can follow. Most traders look for points in the market where the market may reverse. Most traders do not have the trend follower’s mindset, which is to see a large movement in the market and assume that it will continue.

The trend follower views the market as a great place to ride an extended trend and take a large chunk of profit from the markets. The reversal trader believes that most of the time markets will bounce around and that an extended move for a significant amount of time is unlikely. Many of you are probably very aware of the fact that empirical studies that have been applied to the markets have found that most of the time the markets are in fact range bound. This does not mean that trend followers do not make money, it simply means that trend followers must be careful.

What these studies often fail to look at is the timeframe. In other words, what appears to be a range bound market on the daily chart, may in fact be a very strong trend on the 15 minute charts. Thus we may see a scenario where both the trend follower and the reversal trader make money from the same market.

I have been trading a simple trading strategy that has flexible profit targets, thus it is a popular strategy with trend followers and reversal traders find that this method can be useful. Your comfort level with profit targets may depend on your trading personality. The trend follower or the reversal trader can both find reason to be happy with this trade set up. Let me give you an example:

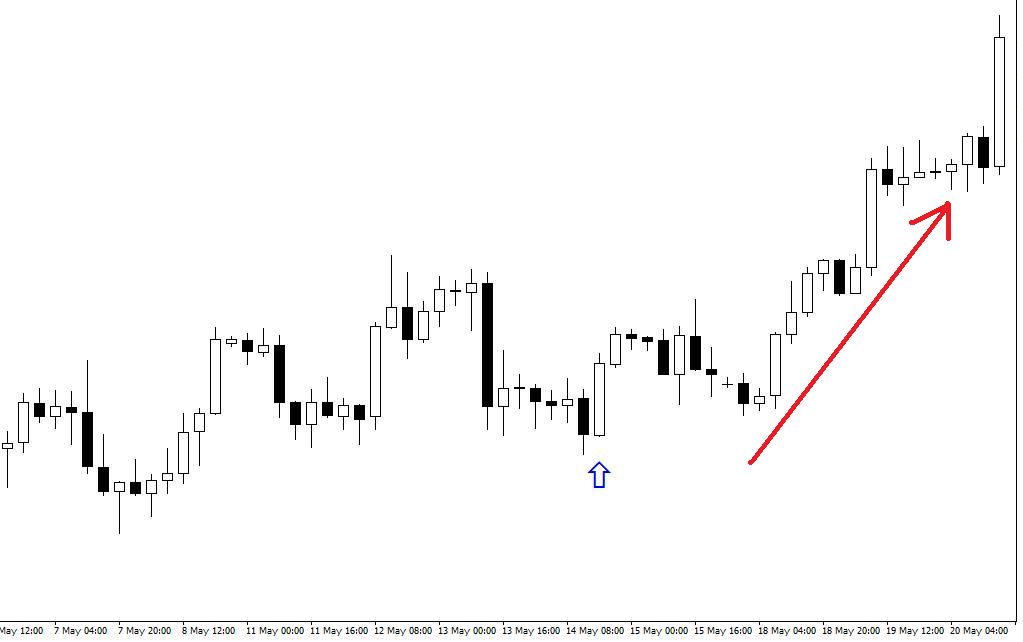

In this chart we can see that the market has generally been moving upward. We see near the right side of the chart that price takes a fall and then pauses at a level that has recently served as support. A bullish candle prints, which may hint that the market may move higher. A trend follower may view this price action as a pullback, or a great opportunity to jump in on the upward trend and ride the dominant direction of the market. A reversal trader may view this as a good opportunity to buy as the market has recently been moving lower and now appears to be reversing. There are many reasons why traders may view this as a good opportunity to buy – the point is that even traders with opposite “trading personalities” may come to a similar conclusion.

In either case, the trader may have decided that the market has recently been moving one direction and it will indeed reverse and move the other direction. In the next chart you can see that this was indeed correct, the market did move higher after the bullish candle. The reversal trader may have taken the trade for a quick profit and the trend follower may still be holding this trade. It is interesting to me that both types of traders may come to the same conclusion regarding the trade setup, and yet “trading personality” may encourage the adoption of different profit targets. Even when traders with different personalities agree on a trade they may find different ways to profit from the setup.

Walter Peters, PhD is a professional forex trader and money manager for the DTS private fund. In addition, Walter is the co-founder of Fxjake.com, and often coaches other traders. If you would like to learn more about Walter’s trading strategies, take a look at Walter’s upcoming webinar.