3 PowerRatings Pullbacks for Short Term Traders: BTH, ALGT, AIRM

The pullback in stocks on Thursday has helped increase the number of high PowerRatings stocks for short term traders to choose from. And while there are not as many 9- and 10-rated stocks as we saw this time one week ago, a number of pullbacks in stocks trading above their 200-day moving averages are worth the attention of PowerRatings traders.

All three stocks in today’s report have PowerRatings of 9. Our stock rating system, PowerRatings, is the product of millions of simulated stock trades since 1995, and has allowed us to rate stocks on a scale of 1 to 10 based on their historical tendency to outperform the average stock in the short term.

Our highest rated stocks, those stocks that have PowerRatings of 10, have outperformed the average stock by a margin of more than 14 to 1 after five days. 9-rated stocks, such as those in today’s report, have outperformed the average stock by a more than 9 to 1 margin over the same short term time frame.

To learn more about how to trade high PowerRatings stocks, click here to read Larry Connors strategy primer, How to Find the Best Stocks to Trade Every Day.

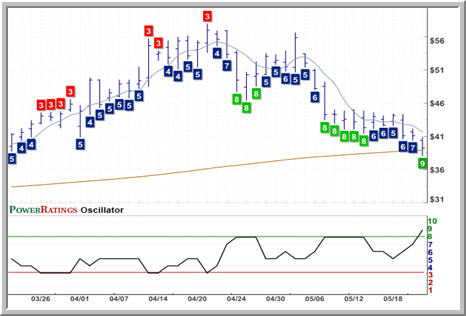

Blyth Inc.

(

BTH |

Quote |

Chart |

News |

PowerRating). This stock has pulled back for three consecutive days and was trading lower intraday on Friday. BTH’s 2-period RSI has fallen below 10 and was below 7 intraday as the stock moved to within $1 of its 200-day moving average.

Allegiant Travel Company

(

ALGT |

Quote |

Chart |

News |

PowerRating). ALGT has also closed lower for three days in a row and is moving lower intraday on Friday. ALGT, which closed on Thursday with a 2-period RSI of less than 8 as it slipped below its 200-day moving average intraday, is above Thursday’s close but still down on the day.

Air Methods Corporation

(

AIRM |

Quote |

Chart |

News |

PowerRating). Like ALGT, Air Methods Corporation experienced enough intraday buying early on Friday to boost its 2-period RSI up from its most oversold levels. Nevertheless AIRM had closed lower for four consecutive sessions going into Friday’s trading, developing a 2-period RSI of less than 6 as of Thursday’s close.

Does your stock trading need a tune-up? Our highest Short Term PowerRatings stocks have outperformed the average stock by a margin of more than 14 to 1 after five days.

| Click here to start your free, 7-day trial to our Short Term PowerRatings! |

Whether you have a trading strategy of your own that could use a boost or are looking for a way to tell the stocks that will move higher in the short term from the stocks that are more likely to disappoint, our Short Term PowerRatings are based on more than a decade of quantified, backtested simulated stock trades involving millions of stocks between 1995 and 2007. Click the link above or call us at 888-484-8220, extension 1, and start your free trial today.

David Penn is Editor in Chief at TradingMarkets.com.

Want updates on our latest articles? Have something to say to David Penn or the staff at TradingMarkets? Follow David on Twitter at @Penn_TM and TradingMarkets at @Trading_Markets.