3 PowerRatings Pullbacks for Traders: ZN, AGN, WTR

Traders are in a selling mood in the first hours of trading on Tuesday, as the major market are all off by about 1%.

That said, many of the stocks that have been underscored here in our PowerRatings Daily Analysis have begun to move higher. This includes both the gold stocks like DRDGold Ltd.

(

DROOY |

Quote |

Chart |

News |

PowerRating) and Newmont Mining Corporation

(

NEM |

Quote |

Chart |

News |

PowerRating), as well as the education stocks, Career Education Corporation

(

CECO |

Quote |

Chart |

News |

PowerRating) and Corinthian Colleges

(

COCO |

Quote |

Chart |

News |

PowerRating). ITT Educational Services

(

ESI |

Quote |

Chart |

News |

PowerRating) is up on the day, but continues to trade below its Monday close.

With the possible exception, then, of ESI, none of these stocks are the best repositories of new capital. Instead, short term traders should instead turn toward some of the other high PowerRatings stocks that are still under the sway of aggressive sellers.

These stocks include Zion Oil & Gas

(

ZN |

Quote |

Chart |

News |

PowerRating), Allergan Inc.

(

AGN |

Quote |

Chart |

News |

PowerRating) – both with PowerRatings of 8 – and a 7-rated stock Aqua America Inc.

(

WTR |

Quote |

Chart |

News |

PowerRating).

Want to know how to find and trade the best stocks everyday? Click here.

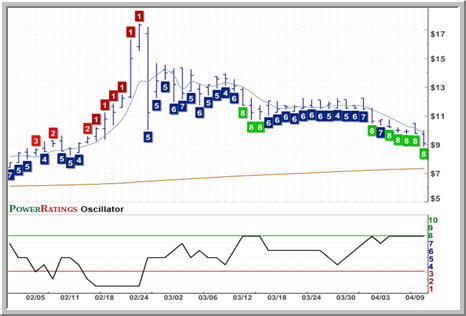

Zion Oil & Gas has been moving lower for the month of April, and has closed lower for the past two days. On Monday, the stock’s 2-period RSI slipped below 1.00 – representing an extremely oversold market and one that is increasingly likely to reverse in the short term.

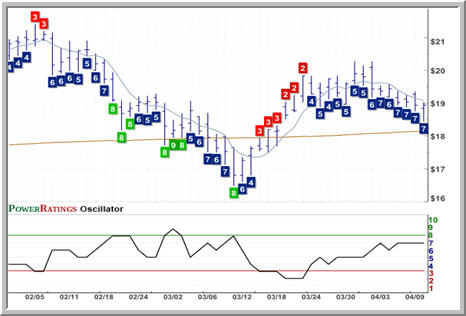

Allergan Inc. actually has been moving in a somewhat downwardly cast trading range in the high 40s. As of the end of trading on Monday, Allergan closed at its lowest level in 14-days, another sign of an exceptionally oversold market. Intraday on Tuesday, Allergan’s 2-period RSI has fallen below 6.

Lastly, I’m including a 7-rated stock in Aqua America, which is also at 14-day closing lows as of Monday. Importantly, Aqua America’s 2-period RSI dropped below 2 intraday on Tuesday as the stock continued to sell-off. Recall that our research indicates that stocks that have 2-period RSIs of less than 2 have produced positive returns in one-day, two-day and one week timeframes.

Should stocks continue to sell off today and/or Wednesday, these stocks are likely to become all the more oversold and that much more attractive as potential opportunities for high probability mean reversion traders.

Our highest Short Term PowerRatings stocks have outperformed the average stock by a margin of nearly 17 to 1 after five days. Click here to start your free, 7-day trial to our Short Term PowerRatings!

David Penn is Editor in Chief at TradingMarkets.com.