3 Top-Rated Pullbacks for PowerRatings Traders: SEE, YHOO, SYMC

The market remains overbought, with given the strength in Asian and Europe overnight, further upside progress on Monday should not surprise PowerRatings traders.

As of the Friday close, 8 out of the top 25 PowerRatings stocks have PowerRatings of 10 — our highest stock rating. We found in our research on short term stock price behavior that stocks with PowerRatings of 10 have outperformed the average stock by a margin of more than 14 to 1.

Could your short term trading use a boost? Click here to try a free trial to our PowerRatings and see what a high probability approach to short term stock trading can do for you!

Among the top-rated stocks in today’s roster are stocks like Sealed Air Corporation

(

SEE |

Quote |

Chart |

News |

PowerRating). SEE (below) has closed lower for the past three consecutive trading sessions and has seen its 2-period RSI plunge from more than 97 to less than 2 over the past five days.

But some of the better, more liquid opportunities for high probability short term PowerRatings traders may lie in the large number of 9-rated stocks in our Top 25. 9-rated stocks have performed only slightly less impressively as 10-rated stocks, outperforming the average stock by a margin of more than 9 to 1.

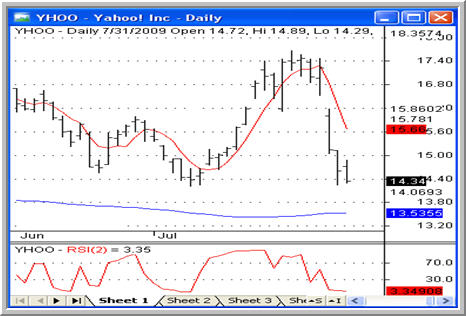

These stocks include a number of well-known names such as Yahoo! Inc.

(

YHOO |

Quote |

Chart |

News |

PowerRating), which has closed lower for three days in a row, with each of those days featuring 2-period RSIs of less than 7.

Yahoo’s close on Friday was its lowest close in a month. Still trading above its 200-day moving average, the stock YHOO hasn’t been this oversold since early July, shortly before the stock began its run from 14.50 to more than 17.

9-rated Symantec Corporation

(

SYMC |

Quote |

Chart |

News |

PowerRating) bounced on Friday, but still remained under significant selling pressure. Its 2-period RSI bouncing from less than 2 to more than 12, any return of sellers that does not push the stock below its 200-day moving average may represent an opportunity in the short term.

For more tips on how to trading high PowerRatings stocks, please review Larry Connors PowerRatings trading primer: How to Find the Best Stocks to Trade Every Day.

Special Note: Larry Connors will be conducting a 2 1/2 day High Probability ETF Trading Seminar beginning August 14. If you’d like to attend a free online presentation explaining the concepts of High Probability ETF Trading and introducing the 2 1/2 day Seminar coming in early August, please call 1-888-484-8220 ext. 1 or click here to register today.

David Penn is Editor in Chief at TradingMarkets.com.