3 Top PowerRating Drug Stocks for Investors: ABT, PFE, LLY

When it comes to stocks with the sort of high reliability and positive outperformance that investors can and should count on, our Long Term PowerRatings are an excellent place to start looking.

One of the best ways to find the best houses is to look in the best communities. And if ever there was a top-notch stock “neighborhood,” then that neighborhood might be Major Drug Manufacturers.

This industry has earned an Industry PowerRating of 10 – our highest rating. Our research into industry group behavior going back to 1995 indicates that top-rated industries have provided average annualized returns of more than 35%. Compare this to the average industry group, which has achieved average annualized returns of less than 15%.

This is the sort of performance that makes Major Drug Manufacturers a leading place for investors to look for stocks. And when we took a look at this industry group this morning, we found three stocks – all with Long Term PowerRatings of 8 – that investors should know more about.

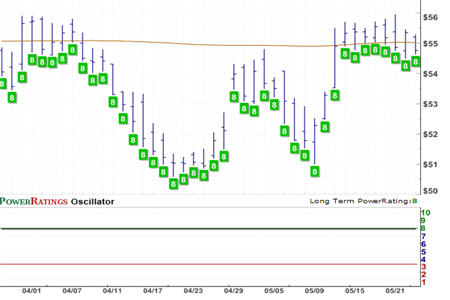

Abbott Laboratories [ABT@ABT] Long Term PowerRating 8. P/E: 22.10.

Shares of Abbott Labs have rallied back to their 200-day moving average, a level at which the stock traded back in earliest April. In recent weeks, Abbott Labs has fallen nearly to $50 and rallied as high as $55.50. The stock has a P/E of 22.10 and a dividend yield of 2.70.

Pfizer Inc. [PFE@PFE] Long Term PowerRating 8. P/E: 17.90.

Pfizer has continued to trend lower and lower over the past several months, most recently moving below the $19.50 level on an intraday basis. Nevertheless, our Long Term PowerRatings still consider Pfizer a stock that is likely to outperform the average stock. Pfizer has a P/E of 17.90 and a dividend yield of 6.60 – the highest of any stock in today’s report.

Eli Lilly Inc. [LLY@LLY] Long Term PowerRating 8. P/E: 14.80

Like Pfizer, shares of Eli Lilly have been in a significant downtrend since the October 2007 peak. The stock has had a Long Term PowerRating of 8 for most of the past few months – save for a period of time in the second half of April when LLY’s PowerRating slid to a 7. Eli Lilly has the lowest P/E of the three stocks in today’s report, and also featured a dividend yield of 4.00.

Looking for more long-term solutions to your investing problems? Don’t let the volatility of this market lead you to miss out on stocks you’ll be glad to have bought a year from now.

| Click here to get a copy of our special, Free Report on the “5 Secrets to Successful Stock Investing,” |

Learn what you need to know as an active investor looking to invest in companies with a history of financial strength and a track record for growth. Click the link above or call us at 888-484-8220 extension 1 to get your copy of the “5 Secrets to Successful Stock Investing” today!

David Penn is Senior Editor for PowerRatings.net.