4 More Nasdaq Stocks for Traders

Yesterday we spotted five stocks in the Nasdaq that we think are likely to outperform the average stock over the next five days. Another day of selling has helped produce four more.

When markets are under pressure, stocks tend to do one of two things. Strong stocks, stocks that are extended above the 200-day moving average, tend to pull back to levels that make them attractive to both traders and investors once again.

Weak stocks, on the other hand, tend to suffer a worse fate when sellers dominate the broader market. When the Dow industrials, S&P 500 and Nasdaq are trading below their 200-day moving averages and sell off, weak stocks tend to suffer the worst. These stocks are the stocks that traders should avoid–even if they are in the midst of surprising rallies. Our research tells us that, over time, stocks trading below their 200-day moving averages simply make for poor short term trades to the upside.

What else does our research, which involved millions of simulated stock trades between 1995 and 2007, tell us? One of the most important products of our investigation into short term stock price behavior was our Short Term PowerRatings.

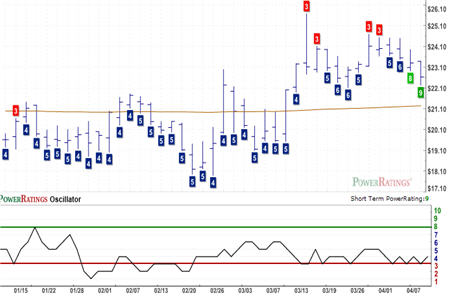

Short Term PowerRatings are a rating system that evaluates stocks on a scale of 1 to 10. Stocks that have earned a Short Term PowerRating of 1 are among the worst performing stocks in the market after five days. We found that, between 1995 and 2007, stocks that received a Short Term PowerRating of 1 actually underperformed the average stock by a margin of 4.9 to 1 after five days.

At the other end of the spectrum were the 10-rated stocks. Stocks with Short Term PowerRatings of 10, between 1995 and 2007, outperformed the average stock by nearly 17 to 1 over the next five days.

Of the four stocks in today’s report, three have Short Term PowerRatings of 8 and one has a Short Term PowerRating of 9. This means that all four stocks are among those stocks that are likely to outperform the average stock over the next five days. 8-rated stocks, according to our research, have outperformed the average stock by a margin of more than 8 to 1, and stocks with Short Term PowerRatings of 9 have done even better. We found that 9-rated stocks actually outperformed the average stock over the next five days by a margin of more than 13 to 1.

In addition to the PowerRatings charts for each of today’s stocks, pay particular attention to the 2-period Relative Strength Index values, as well. We consider a stock to be oversold when its 2-period RSI falls below 10, and extremely oversold when that number drops below 2. As you can see, all of the stocks into today’s report are oversold as of this writing, with one stock being extremely oversold and arguably most likely to bounce.

ExlService Holdings

(

EXLS |

Quote |

Chart |

News |

PowerRating). Short Term PowerRating 9. RSI(2): 3.90

Third Wave Technologies

(

TWTI |

Quote |

Chart |

News |

PowerRating). Short Term PowerRating 8. RSI(2): 7.24

Valence Technologies

(

VLNC |

Quote |

Chart |

News |

PowerRating). Short Term PowerRating 8. RSI(2): 1.88

Superior Well Services

(

SWSI |

Quote |

Chart |

News |

PowerRating). Short Term PowerRating 8. RSI(2): 6.03

Does your stock trading need a tune-up? Read our special, Free Report, “5 Secrets to Short Term Stock Trading Success” for a refresher course on not just why to buy low and sell high, but specifically how you can use intraday weakness in the market to do so. Click here to get your copy of “5 Secrets to Short Term Stock Trading Success” or call us today at 888-484-8220.

David Penn is Senior Editor at TradingMarkets.com.