4 Oversold Stocks for Traders

When markets are moving lower, some stocks are becoming truly “cheaper” while others are simply becoming less expensive. Know the difference between a “cheap” stock and a good stock on sale can make all the difference in your success as a short-term trader.

A “cheap” stock is like a cheap suit. It costs less for a reason. Poor quality.

But a stock that is good, generally performing well, and suddenly finds itself on sale is simply good merchandise at good prices, the object of any savvy buyer in any marketplace: from stocks to silver to structured investment vehicles (SIVs).

Our TradingMarkets Stock Indicators help keep traders focused on the right kind of stocks. When it comes to selling, our indicators help show traders opportunities to bet against “cheap” stocks. And when it comes to buying, our indicators help traders avoid buying “cheap” and instead buy good stocks on sale.

How do our indicators do this? Two ways. First we make sure that the indicator is truly recognizing an exceptional condition. If a store puts on a 1% sale, then few customers who weren’t headed there in the first place are likely to change their plans to go shipping. But if a store puts on a 10%, or 20% sale, then people will soon find themselves ready to fill shopping carts. If the discount is steep enough, people will have no problem buying things they don’t even need.

Our higher highs and lower lows indicator exploits this. When markets make lower lows session after session after session, we are far more inclined to buy than to sell. Our research into lower lows has showed us that, in the short-term, there is an edge to buying lower lows, particularly after a stock has made five or more consecutive lower lows. After five or more consecutive lower lows, we found that the right stocks, the stocks that were not “cheap”, produced positive returns in one-day, two-day and one-week timeframes.

Click here to read our research into short-term trading with higher highs and lower lows.

This, of course, is not enough. We do not just want to buy based on a low price. After all both “cheap” and inexpensive tend to be low in price. We want to make sure that the low priced items we purchase are of good quality. It is that good quality, in fact, that gives us the confidence to buy even when the price is moving lower.

This is where the second part comes in. When it comes to stocks, the “good housekeeping” seal is awarded to those stocks that are trading above their 200-day moving averages. That is how we separate, in a list of stocks all of which may be pulling back, the “cheap”stocks from the merely inexpensive ones.

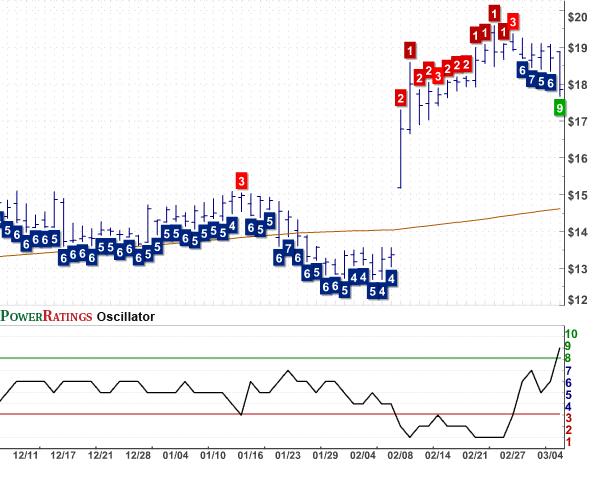

Below is a set of four, oversold stocks that have become inexpensive after making multiple lower lows. Note that some of these stocks also have extremely low 2-period RSI values, which emphasizes the degree to which these stocks are very oversold and due for a bounce. Lastly, all of the four stocks have PowerRatings of 8. Based on our research into short term stock behavior, stocks with Short Term PowerRatings of 8 outperformed the average stock by more than 8 to 1 over the next five days.

Dime Community Bancshare

(

DCOM |

Quote |

Chart |

News |

PowerRating). RSI(2) 11.65

Lennox International Inc.

(

LII |

Quote |

Chart |

News |

PowerRating). RSI(2) 1.34

MFA Mortgage Investments Inc.

(

MFA |

Quote |

Chart |

News |

PowerRating). RSI(2) 0.22

Vnus Medical Tech

(

VNUS |

Quote |

Chart |

News |

PowerRating). RSI (2) 4.24

David Penn is Senior Editor at TradingMarkets.com.