4 Stocks, 2 Trades

A low RSI and being down more days than up are two ways that traders can spot stocks that are likely to outperform the average stock in the short term.

Of the four stocks in today’s report, two are examples of stocks that have experienced a great deal of selling in a relatively short period of time. The other two are instances of stocks that have become exceptionally oversold, as revealed by their 2-period Relative Strength Index values below 5.

Four stocks. Two ways that traders can find opportunities as stocks move lower and become less expensive to buy.

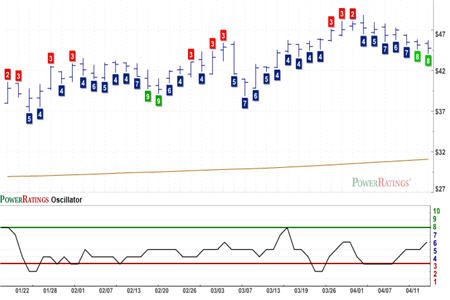

First, let’s take a look at the two stocks that are getting hit by a great deal of selling: Olympic Steel and Meridian Bioscience.

Both of these stocks made short term highs last week. And since those highs, both stocks have pulled back. So far, the pullbacks in both ZEUS and VIVO are relatively mild. But what is noticeable about the pullbacks is how aggressive the selling has been. Shares of both ZEUS and VIVO have closed down four out of the past five sessions, helping create the sort of oversold conditions that encourage buyers to step in and pick up stock that profit-taking has put “on sale.”

Olympic Steel

(

ZEUS |

Quote |

Chart |

News |

PowerRating)

Meridian Bioscience

(

VIVO |

Quote |

Chart |

News |

PowerRating)

Both Olympic Steel and Meridian Bioscience have Short Term PowerRatings of 8. 8-rated stocks, according to our research into short term stock price behavior, have tended to outperform the average stock by a margin of more than 8 to 1 after five days. Combined with the selling in recent days, both stocks have become increasingly attractive candidates for swing trades to the upside.

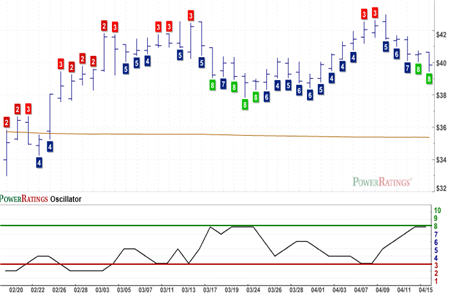

The second “trade” is the straight oversold trade. Here, we are looking for stocks that have exceptionally low, 2-period RSI values. While the idea of buying oversold stocks is hardly one we invented, the 2-period RSI, an indicator that is both more sensitive to short term price movement as well as being more demanding in terms of what qualifies as oversold, is one idea we are pretty proud to share with short term traders.

It was a search for stocks with exceptionally low 2-period RSIs that gave us these two very oversold stocks: Trico Marine Services and Union Drilling. Trico Marine Services has a 2-period RSI of 2.64, and has been down for three of the last five days.

Trico Marine Services

(

TRMA |

Quote |

Chart |

News |

PowerRating)

Union Drilling has a 2-period RSI of 3.50, not quite as low as Trico Marine Services, but still a very low number for the stock, and the kind of number that increases the likelihood that UDRL will be higher over the next few days.

Union Drilling

(

UDRL |

Quote |

Chart |

News |

PowerRating)

These two set-ups, stocks that have experienced multiple down days and stocks that are exceptionally oversold by virtue of their low 2-period RSI values, are trading methods that you can add to your set of trading strategies immediately. For traders who use other methods, such as breakouts, adding these sort of mean reversion, pullback trading set-ups can help you take advantage of opportunities that other “buy high, sell higher” methods might not.

For more simple and straightforward tips on short-term stock trading, consider getting a copy of our free report, written especially for those who trade stocks in the short-term “sweet spot” of five to eight days. Click here to get your copy of “5 Secrets to Short Term Stock Trading Success”–or call us at 888-484-8220–and see what the TradingMarkets approach to trading can do to make you a better trader.

David Penn is Senior Editor at TradingMarkets.com.