4 Top PowerRatings Stocks for Traders

Who would have thought that a lower Fed funds rate would lead to a pullback in gold and mining related stocks?

That’s just what traders have seen this week as the move toward even greater monetary accommodation by the Bernanke Fed sent holders of stocks like the four in today’s report scurrying for the exits.

Profit-taking? Panic selling? Who knows what encouraged the holders of these stocks and, in one case, exchange-traded fund to sell. The important thing is that the selling is increasingly creating opportunities for buyers of weakness to scoop up shares that only a few days ago were significantly more expensive.

This is at the core of what makes our Short Term PowerRatings so helpful. While the rest of the trading world is pondering the meaning of the apparently out-of-nowhere collapse in many formerly high-flying gold and mining stocks, traders using Short Term PowerRatings know that their task right now is simply sit back and wait for these stocks on pullback to “come to Daddy” (or “Mommy”, for that matter).

Why? Because as buyers of weakness, we are looking for strong stocks, stocks that are trading above their 200-day moving averages, stocks that are making higher highs, and becoming more and more overbought. Not so we can chase these stocks higher, but so we can note them as the sort of strong stocks we would like to own (even for just a few days) when they go on sale.

In other words, we flag high-flying stocks so that when they inevitably pull back, we know that these are the stocks that are most likely to rebound, potentially to new highs. Those “flags” are, in essence, our Short Term PowerRatings. A stock with a high Short Term PowerRating tends to be a stock that has been performing well, but is under recent selling pressure. And like picking a winning team that has just stumbled through a tough part of its schedule, buying strong stocks that have slipped into momentary disfavor is a tremendous edge for stock traders of all types–but especially for those working in the short term.

Because the broader markets are under pressure and continue to trade below their 200-day moving averages, I have screened today’s list of top PowerRatings stocks so that we can look only at those that are trading above their 200-day moving averages. This is another area in which our research has determined where edges lie in the short term and where they do not. And one of the conclusions of our analysis of millions of simulated trades since 1995 is that there is no short-term edge for traders in buying stocks that are below their 200-day moving averages when the broader markets–the S&P 500, the Nasdaq, the Dow industrials–are also trading below their 200-day moving averages.

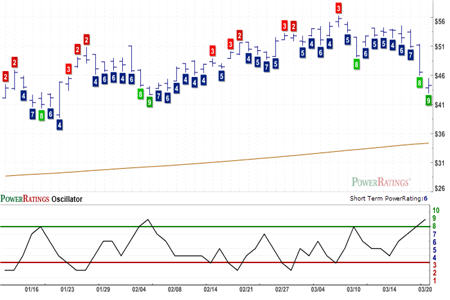

All of the stocks in today’s report have Short Term PowerRatings of 8 or 9. In addition to the PowerRatings charts provided below, I have also noted the 2-period RSI of each stock so that traders can gauge just how oversold these names are right now.

Randgold Resources

(

GOLD |

Quote |

Chart |

News |

PowerRating). Short Term PowerRating 9

S&P SPDRs Metals and Mining Fund ETF

(

XME |

Quote |

Chart |

News |

PowerRating). Short Term PowerRating 8

Stillwater Mining

(

SWC |

Quote |

Chart |

News |

PowerRating). Short Term PowerRating 8

Taseko Mines

(

TGB |

Quote |

Chart |

News |

PowerRating). Short Term PowerRating 8

Tired of losing money trading breakouts and breakdowns? Our special, Free Report, “5 Secrets to Short Term Stock Trading” will show you some of the key strategies and attitudes that traders throughout history have used to determine the right time to buy and the right time to sell. Click here to get your free copy of “5 Secrets to Short Term Stock Trading” — or call us today at 888-484-8220.

David Penn is Senior Editor at TradingMarkets.com.