4 Top PowerRatings Stocks for Traders: VNUS, TRA, SLW, MON

To steal a line from George Orwell’s classic novel, Animal Farm: some high Short Term PowerRatings stocks are more equal than others.

When markets are under pressure, even being a high Short Term PowerRating stock might not be enough to get the outperformance you demand as a trader. While any stock with a high Short Term PowerRating is likely to outperform a stock with an average or low Short Term PowerRating over the next five to eight days, traders want to maximize every opportunity, gain every edge they can that will help them be more successful.

Ever since the creator of Short Term PowerRatings Larry Connors wrote his widely-circulated article last fall, “5 Mistakes to Avoid in a Market Trading Below its 200-day Moving Average”, I have been making a point to select and highlight not just any high Short Term PowerRating stock. Instead, I have focused only on those stocks with Short Term PowerRatings of 8, 9 or 10 that are also trading above their 200-day moving averages.

Why? Our research has found that the 200-day moving average acts as a very good filter for stocks. In general and on average, stocks that are above the 200-day moving average tend to outperform the average stock, while stocks that are below the 200-day moving average tend to underperform the average stock. This is true for all stocks–whether they have Short Term PowerRatings of 1 or Short Term PowerRatings of 10.

But the goal is to have as many advantages on your side. So if we know that the tendency of a stock below the 200-day moving average is to underperform the average stock, why would we potential waste time and money buying stocks–even 10-rated stocks–below this level? This is true especially if there are other opportunities, other stocks that have high Short Term PowerRatings and are trading above their 200-day moving averages. But even if the only high PowerRatings stocks on a given day were all trading below their 200-day moving averages, that fact would be no excuse to trade them. Rather it would be an opportunity to stay on the sidelines, to keep the bat on the shoulder, so to speak, until the right opportunity comes to pass.

This can be difficult for many short-term traders, who by nature tend to want to shoot first and ask questions later (otherwise they’d probably be long-term trend traders!). It is just as difficult to buy weakness, fearing that if a stock is already oversold, then waiting for the stock to become even more oversold risks losing out on the opportunity should the stock suddenly bounce, never falling low enough to trigger our entry.

But these are the pathways to truly professional caliber trading. Professional and veteran traders know that there is always another stock, always another pullback and that letting a so-so opportunity go untouched–such as a 10-rated stock that’s several points below its 200-day moving average–likely saves precious capital for the moment when a truly superior opportunity manifests itself.

Here are four stocks that just might represent those sorts of superior opportunities. All of the four have Short Term PowerRatings of 8. This means that all of these stocks belong to that category of stock which has outperformed the average stock by a more than 8 to 1 margin over the next five days. I have also included the 2-period Relative Strength Index values for each stock so that traders can get a good sense of just how oversold some of these high Short Term PowerRatings stocks are as of the most recent close.

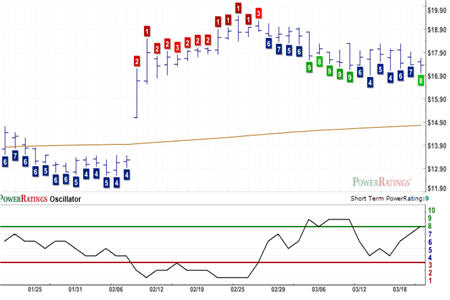

VNUS Medical Technology

(

VNUS |

Quote |

Chart |

News |

PowerRating)

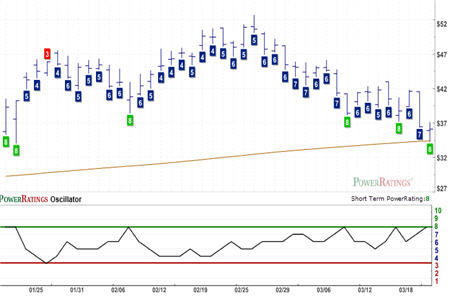

Terra Industries

(

TRA |

Quote |

Chart |

News |

PowerRating)

Silver Wheaton

(

SLW |

Quote |

Chart |

News |

PowerRating)

Monsanto

(

MON |

Quote |

Chart |

News |

PowerRating)

If you are looking to take your trading to the next level, then consider grabbing a copy of our special, Free Report on short-term stock trading: “5 Secrets to Short Term Stock Trading Success.” This report will clue you in on the most important principles and best practices that short-term traders have used in order to make money from the inefficiencies and mispricings that appear in the stock market every day. Click here to get your copy of “5 Secrets to Short Term Stock Trading Success” or call us today at 888-484-8220.

David Penn is Senior Editor at TradingMarkets.com.